Business Expense Mileage Rate 2020

Use the rates listed below to calculate the allowable expense for using your vehicle for business purposes for the 2019-2020 income year. The IRS allows employees and self-employed individuals to use a standard mileage rate which for 2020 business driving is 575 cents per mile.

The Deductible Mileage Rate For Business Driving Decreases For 2020

You can claim mileage on your tax return if you kept diligent track of your drives throughout the year.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Business expense mileage rate 2020. Multiply your business miles driven by the standard rate 575 cents in 2020. 17 cents per mile driven for medical or moving purposes down from 20 cents in 2019. 575 cents per business mile.

If a business owner logs 100000 miles over the next few years this totals a massive 58000 in deductions. Carrying through the example above. For 2020 the federal mileage rate is 0575 cents per mile.

Kilometre rates for the 2017-2018 income year. You can deduct these costs if youre self-employed. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and.

Once you have determined your business mileage for the year simply multiply that figure by the Standard Mileage rate. Accordingly the 2020 IRS standard mileage rates are. To determine the number of miles driven for business you need two numbers for each business vehicle.

Thats a drop of 3 cents from 2019. 575 cents per mile of business use. Reimbursements based on the federal mileage rate.

The standard mileage rate or the actual expense method. As we rely on third-party information that was delayed due to COVID-19 we were previously unable to provide these rates and advised businesses to use the kilometre rates for the 2018-2019 income year instead. For the 2020 tax year the rate was 0575 per mile.

Thats a drop of 05 cents from 2019. 14 cents for charitable reasons. Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be.

The business cents-per-mile rate is adjusted annually. 17 cents per mile to cover moving or medical purposes. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile.

Kilometre rates for the 2019-2020 income year Use these rates to work out your vehicle expenses for the 2019-2020 income year. As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p. Potentially larger deduction with the actual expense method.

5000 business miles x 0575 standard rate. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020. The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December.

17 cents per mile for medical or moving. The mileage rate for the 2021 tax year is 056 per mile driven. The total number of miles driven during the year.

The IRS increases the standard mileage rate or mileage reimbursement rate each year to keep pace with inflation. The IRS mileage rates for 2020 for business vehicle use are. For this year the mileage rate in 2 categories have gone down from previous years.

The IRS sets a standard mileage reimbursement rate. 575 cents per mile for business miles 58 cents in 2019 17 cents per mile driven for medical or moving purposes 20 cents in 2019. The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021.

For tax year 2020 the Standard Mileage rate is 575 centsmile. Theyre identical to the rates that applied during 2019-20. It was 58 cents for 2019 and 545 cents for 2018.

Youre likely to benefit from using the standard mileage rate if you drive an old or inexpensive vehicle. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Beginning on January 1 2020 the standard mileage rate for the business use of a car van pickup or panel truck is 575 cents per mile.

As a rule youll be better off using the standard mileage rate if you drive a smaller car particularly if you drive many business miles. Cons of using the standard mileage rate. 575 cents per mile for business miles driven down from 58 cents in 2019.

See section 404 of. This rate has remained steady for years. Each year the IRS sets the rate each mile driven for work is worth.

IRS Mileage Rate For 2020. Kilometre rates for the 2018-2019 income year Use these rates to work out your vehicle expenses for the 2018-2019 income year.

Instructions For Form 2106 2020 Internal Revenue Service

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

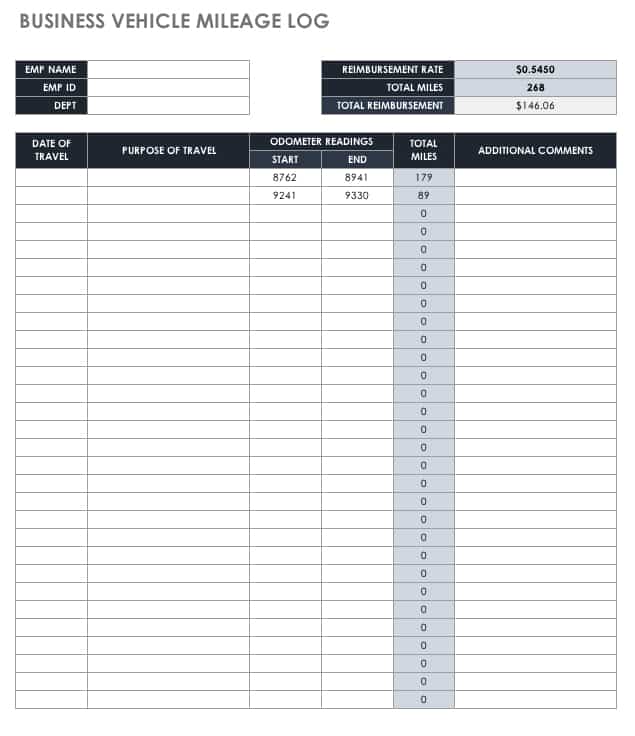

Free Mileage Log Templates Smartsheet

![]()

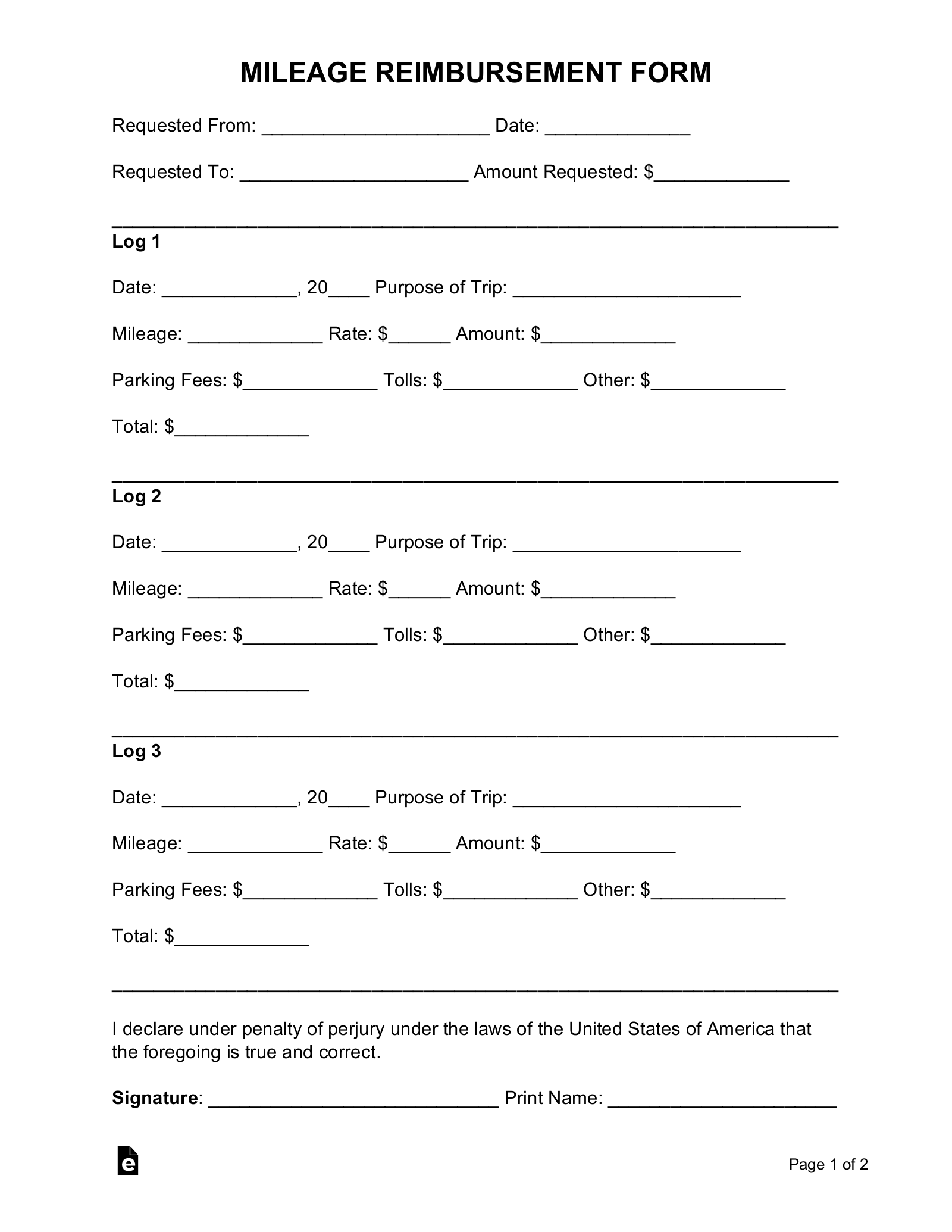

Free Mileage Tracking Log And Mileage Reimbursement Form

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Free Expense Reimbursement Form Templates

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Your Guide To 2020 Irs Mileage Rate I T E Policy I

New Mileage Rate For 2020 Mileage Expenses

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2020 Mileage Rates For Business Medical And Moving Announced Wilkinguttenplan

Standard Mileage Rates For 2020 Dalby Wendland Co P C

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Https Mn Gov Mmb Assets 20200102 Tcm1059 414823 Pdf

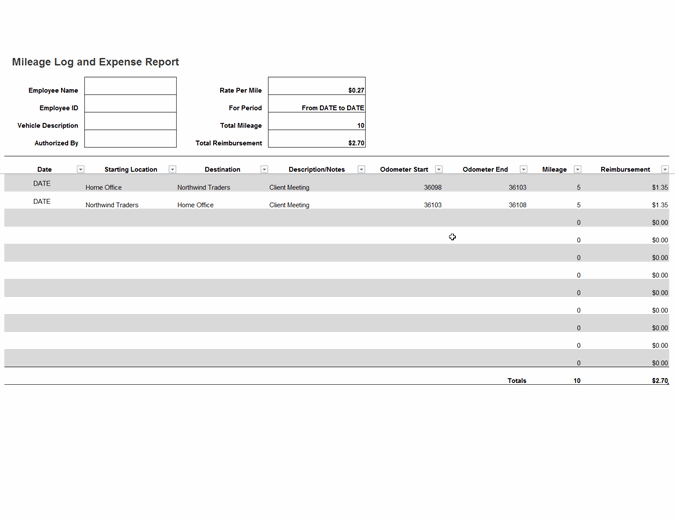

Mileage Log And Expense Report

Free Mileage Log Templates Smartsheet

Post a Comment for "Business Expense Mileage Rate 2020"