Business Registration Tax Number Wv

Remote sellers do not use this form. West Virginia State Tax Department PO Box 2666 Charleston West Virginia.

West Virginia Business Search Corporation Llc Partnership Zenbusiness Pbc

Even small businesses need and can benefit from a WV Tax ID Number.

Business registration tax number wv. View the information below to learn more about State Tax Department filing requirements and filing due dates. However each business is required to complete tax filings by specific due dates determined by the State Tax Calendar for specific filing submissions. Business4WV Start Federal IRS Tax EIN Registration Federal IRS Tax EIN Registration An Employer Identification Number EIN also known as a Federal Employer Identification Number FEIN is a tax number issued by the Internal Revenue Service IRS to identify a business entity.

The State Tax Department issues permanent business registration licenses. Monday - Friday 830 AM to 500 PM. For example if you use your social it will be on every business application you fill out because it will be your business tax ID.

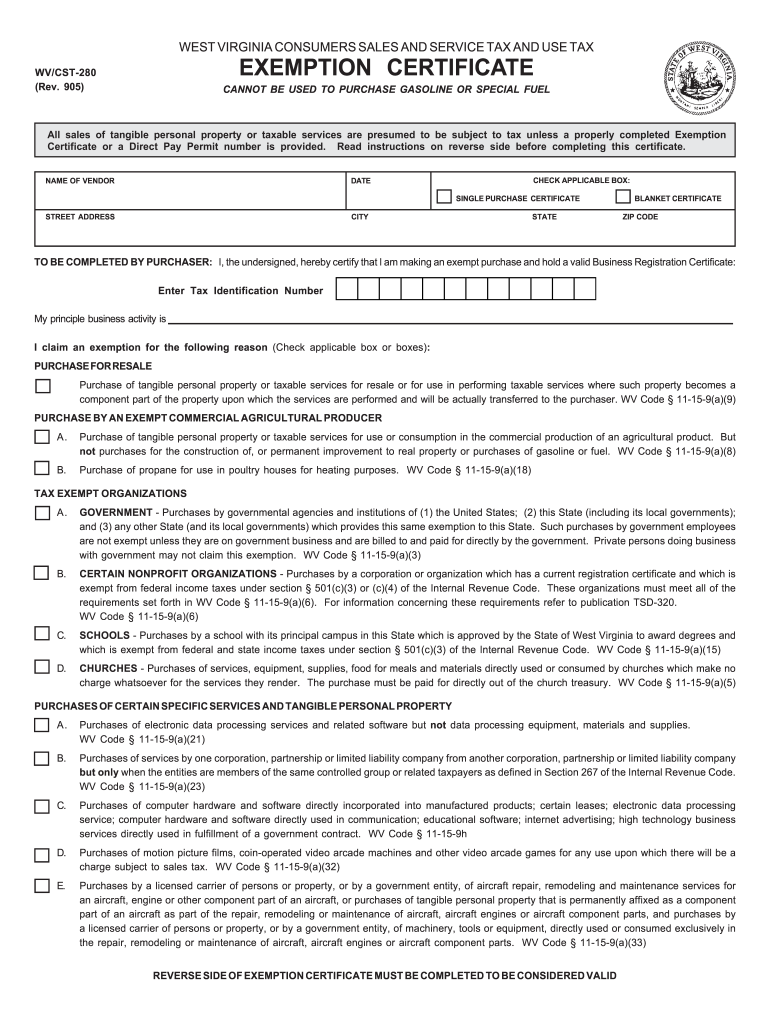

Basic Forms for Registering a Business in West Virginia. Engaging in business within theState of West Virginia without obtaining a Business Registration Certificate when required by law is a serious offense and could subject you to penalties of up to 10000 a day for each day you continue to operate your business without a license. WV BUS-APP Rev 01-19 WEST VIRGINIA NEW BUSINESS REGISTRATION APPLICATION Register online at business4wvgov.

Federal Tax ID Number. Used to Close a Business Registration. Before engaging in business activity in West Virginia every individual or business entity is required to register with the West Virginia State Tax Department to obtain a Business Registration Certificate ie the Business License to obtain a business license identification number and maintain a State Tax Department account.

Select Details to view additional information including full address registered number. Generally speaking most businesses need an EIN. That telephone number is 1-866-816-2065.

WV One Stop Business Center 1615 East Washington Street Charleston WV 25311-2126. Here are some advantages. Apply for an Employer Identification Number EIN online at the Website of the Internal Revenue Service.

Federal IRS Tax EIN Registration. Taxwvgov West Virginia Business Registration Information and Instructions 3 HOW DO I REGISTER. The West Virginia Secretary of States Office makes every reasonable effort to ensure the accuracy of information.

Finding and Training Employees. Number for the service center for West Virginia. When you enter a business entity name and click the search button you will receive entity names that match your search criteria along with entity type city and status.

Application for Name Reservation - Reserve for a period of 120 days through the Secretary of Sate the business name you want to use when registering a business formed or qualified through the Secretary of States Office. Most businesses must register with West Virginia Secretary of State. West Virginia requires every entity to obtain a Business Registration Tax Number.

Federal Employer Identification Number FEIN - Register with the IRS for the FEIN using IRS Form SS-4 or apply online. Contact the West Virginia State Tax Department at 304 558-3333 or 800 982-8297. Special Notice 10-01 Permanent Business Registration Certificate Information.

North American Industry Classification System Tax Information and Assistance. Back to Corporations Search. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map.

To register with the West Virginia State Tax Department you must complete the Application for Registration Certificate Form WV BUS-APP in this booklet and return to. BUS-FIN Declaration of Final Business Activity. This service will enable you to view registration information on West Virginia corporations and other business types which file with the Secretary of State.

If you are engaged in business activity a business registration certificate can be obtained by filing an application either through the Business for West Virginia Website or by filing a BUS-APP with the Tax Commissioner. The following business structures register through the West Virginia State. Occupational Professional and Special Licenses and Permits.

Corporations and LLCs as well as partnerships and independent contractors are required to have it but sole proprietors need it to use instead of a social security number. These codes are requested on your Business Registration Application and can be attained here. Remote sellers should register at mytaxeswvtaxgov If you are making changes to a business already registered with the WV State Tax Department do not.

A separate business registration certificate is needed for each location in this State at or from which business is engaged. Sports Bar Grill Tax ID Registration in Charles Town WV Liquor License Where To Find Wv Tax Id Number 25414. However we make no representation or warranty as to the correctness or completeness of the information.

When you receive your FEIN notify West Virginia State Tax Department so your temporary number can be changed in our computer file. The Business Registration Certificate is a permit to conduct business in the State and must be displayed at all times at the place.

How To Get A Certificate Of Exemption In West Virginia Startingyourbusiness Com

West Virginia Foreign Llc Registration Get Your Certificate Of Authority

Incorporate In West Virginia Do Business The Right Way

Title Questions For West Virginia Vehicle Donation

Https Www Elcotech Austria Com Wp Content Uploads 2020 11 2020 11 10 Elcotech Austria Wv Business Registration Certificate Pdf

Start An Llc In West Virginia 38 Nw Registered Agent

West Virginia Purchasing Division

West Virginia Business Entity Search Corporation Llc

Wv Dor Cst 280 2005 2021 Fill Out Tax Template Online Us Legal Forms

Active Covid 19 Cases Decreasing In Wv Wowk 13 News

How To Register For A Sales Tax Permit In West Virginia Taxjar Blog

Post a Comment for "Business Registration Tax Number Wv"