Business Expenses Higher Than Income

You cant spend less than 0. If you have room and can still pay yourself a salary and pay taxes then you have to decide whether to increase your salary to cover your household expenses spend money on some of the W business expenses or both.

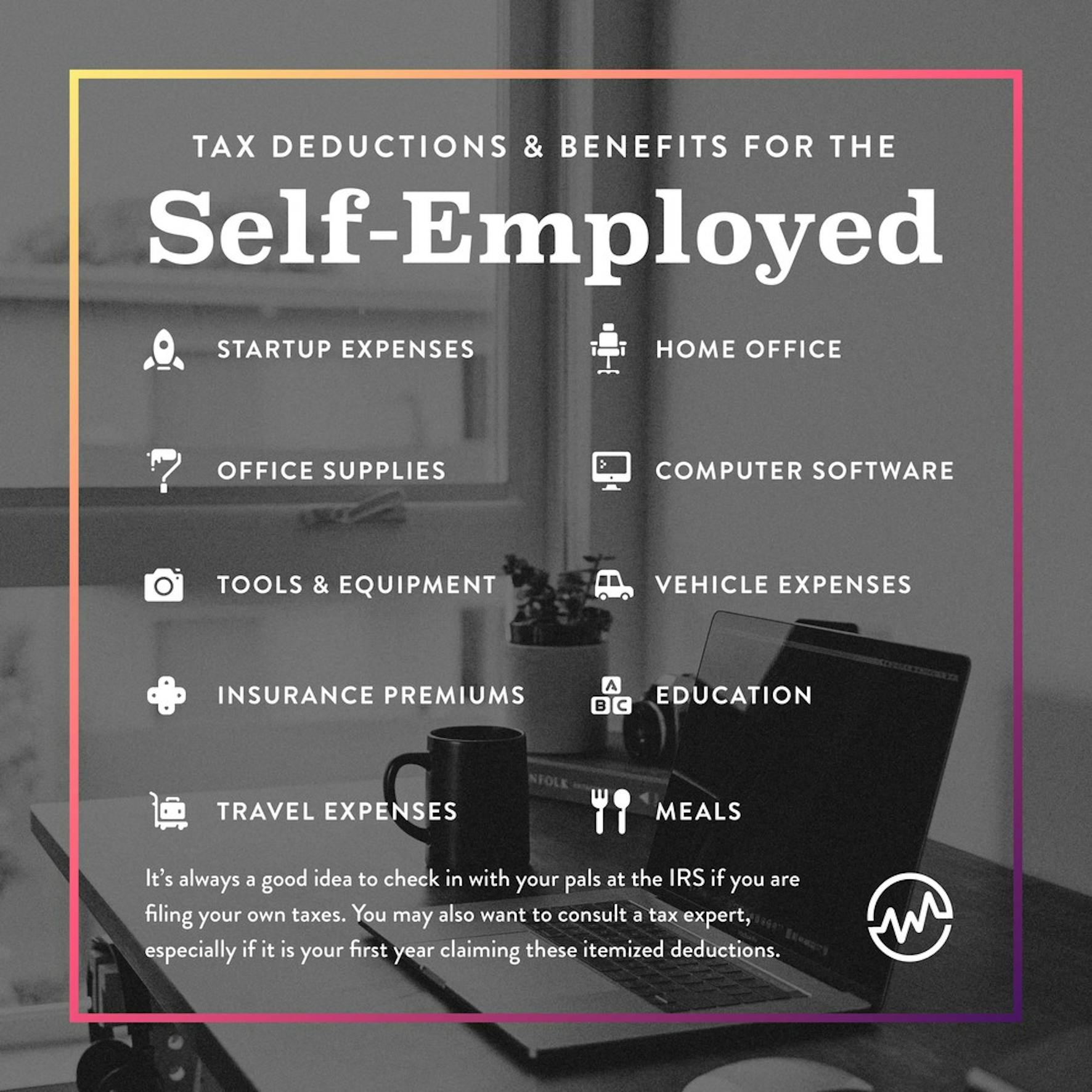

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

Typically if a small business continues to run at a loss meaning expenses are higher than income repeatedly the IRS will become interested within 3 5 years.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

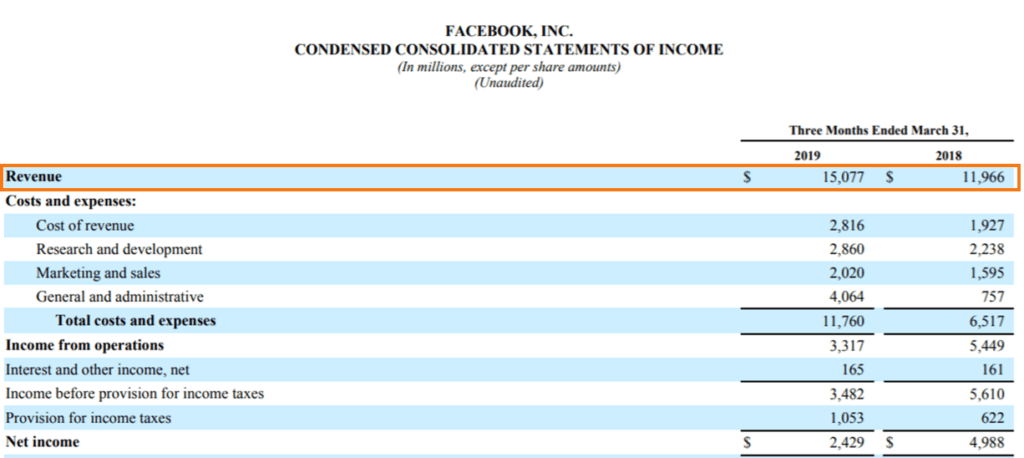

Business expenses higher than income. You would have to under cost of goods sold. The Internal Revenue Service refers to this situation as a net operating loss. Earned income includes all the taxable income and wages from working either as an employee or from running or owning a business.

However taxes are rarely simple and its entirely possible that you could lose money for tax purposes when you have a profit or have to pay taxes when you actually lost money. Using Business Loss Against Other Income Whether you get to use this business loss and claim the business expenses depends on whether or not you have other income. Yes and legally you should claim all eligible business expenses along with all income.

As for inventory that which has not been sold. It also includes certain other types of taxable income. Is it OK to have business expenses more than business income ie negative business income.

If you have a business you pay taxes on your profit. Your deductible business interest expense in a year cant be greater than the sum of. Wages salaries tips and other taxable employee pay.

Your net income from self-employment is what. Non-Operating Expenses Non-Operating Expenses. 1 your present situation is unsustainable.

Net Income 8400 Net Income. The way you deal with it depends on what caused the losses and how long the losses have been occurring. In order for the expenses to be deductible you have to itemize deductions instead of taking the standard deduction and only expenses that exceed 2 of your adjusted gross income.

However if you consistently have losses 3 years or more for example then the IRS could come back and consider this a hobby instead of a business. When expenses are higher than your income it means several things. Spending more than you earn is not a wise choice.

Long-term disability benefits received prior to minimum retirement age. You can go to this by going to top left under view drop down to forms click on schedule C scroll down the form to part III cost of goods sold. If your business expenses exceed your business income you will record a business loss on this form.

When your expenses are much higher than your income your financial life gets ruined and you find yourself drowning in the sea of debt. Finance is always unique to the individual. Just like how the balance in your bank account doesnt always give you the whole story the total of your income minus your expenses.

In fact of the two only expense reduction has an inherent limit. You can change it for the better before the worst happens. Beginning inventory assuming you did not do.

You can only reduce your expenses to a certain level. For example maybe you dont mind taking a lower salary because money isnt why you run your business. When they do the business may get reclassified as a hobby if the business owner cant prove he is really trying to make a profit.

Settling your bills and saving up money for the future would be quite difficult due to shortage of money. Your business interest income for the year. There could be certain justifications for why your expenses are higher than 30.

In general this does not cause problems. It sells your income to the future. How Long Can You Run a Business at a Loss.

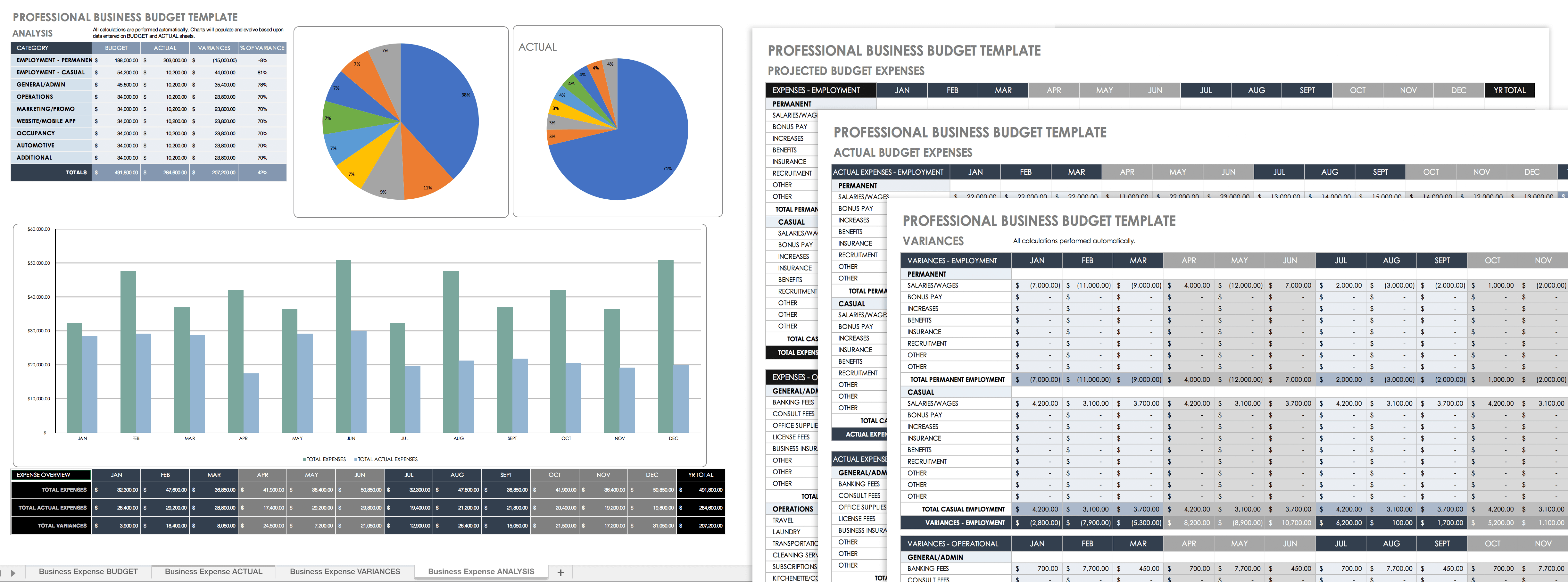

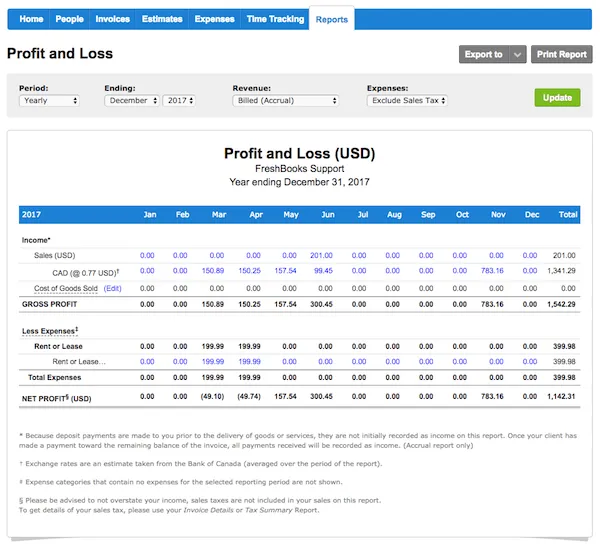

In the simplest possible terms if you have 100000 in sales and 70000 in expenses youd have 30000 in profits and owe taxes on it. If the total N business expenses exceed your gross business income plus what you estimate for taxes then its time to make cuts. Operating Income 8400 Operating Income 12100.

If unchecked youll be creating debt once your savings cushion is gone. You will put in your purchases for resale and ending inventory at year end. Plus 30 of your adjusted taxable income ATI for the year and Your floor plan financing interest expense for the year this part is primarily for auto dealers.

Likewise there are limitations as to how much expense reduction can help you. Net income is sometimes called profit If your self-employment income is higher than your business expenses you report this net income. Total Operating Expenses.

Businesses or individuals rarely end up with more deductions than income. But there needs to be a really good reason that actually justifies your expenses. If your business expenses are higher than your income you report a net loss.

You can claim all business related expenses. If you normally spend 2500 a month the most you can save by reducing expenses is 2500 per month.

Operating Income Vs Gross Profit

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

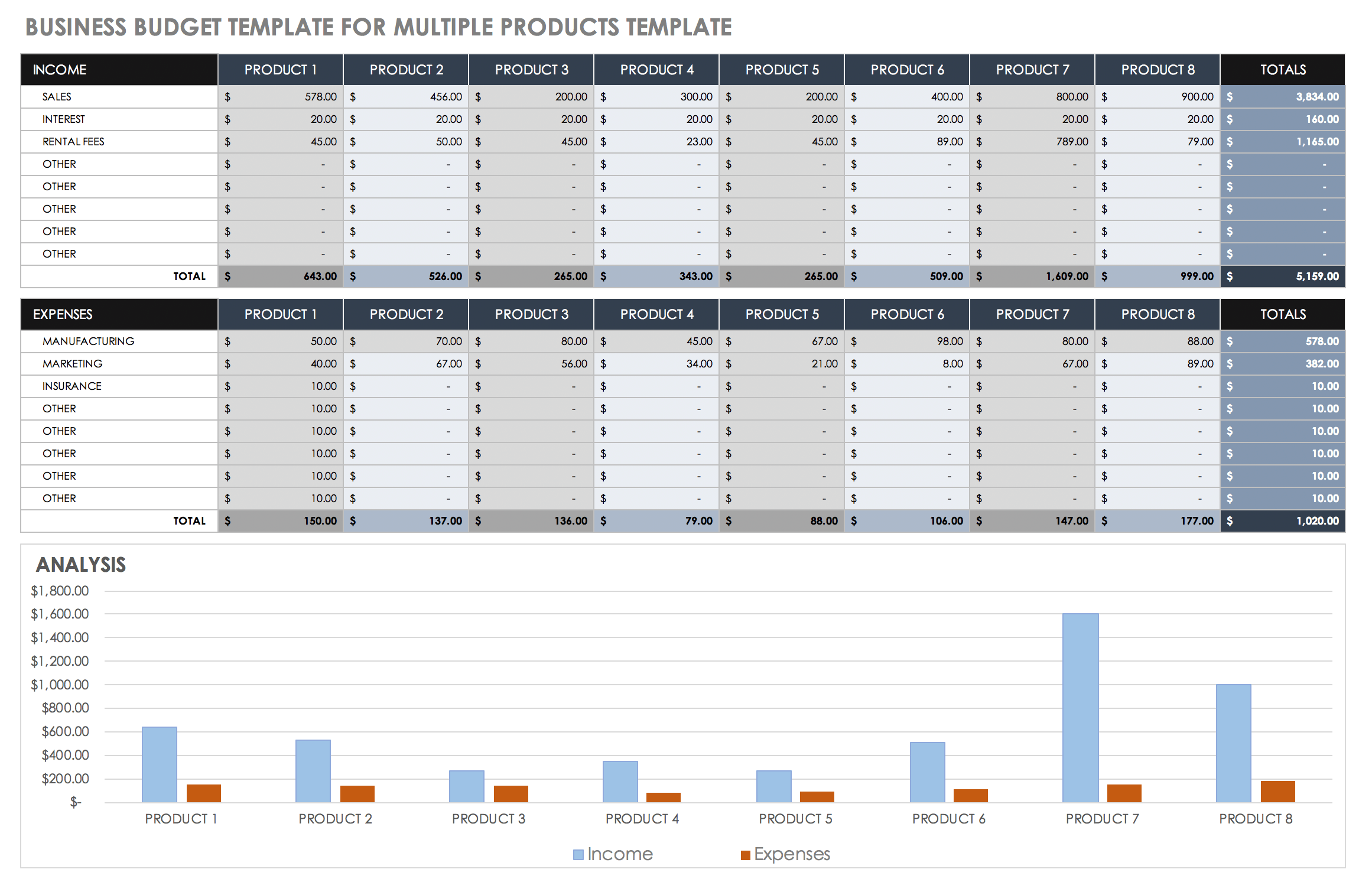

Free Small Business Budget Templates Smartsheet

Earned Income Vs Unearned Income What S The Difference Millers On Fire

How To Pay Little To No Taxes For The Rest Of Your Life

Income Vs Revenue Vs Earnings Overview Examples

Understanding Profitability Ag Decision Maker

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

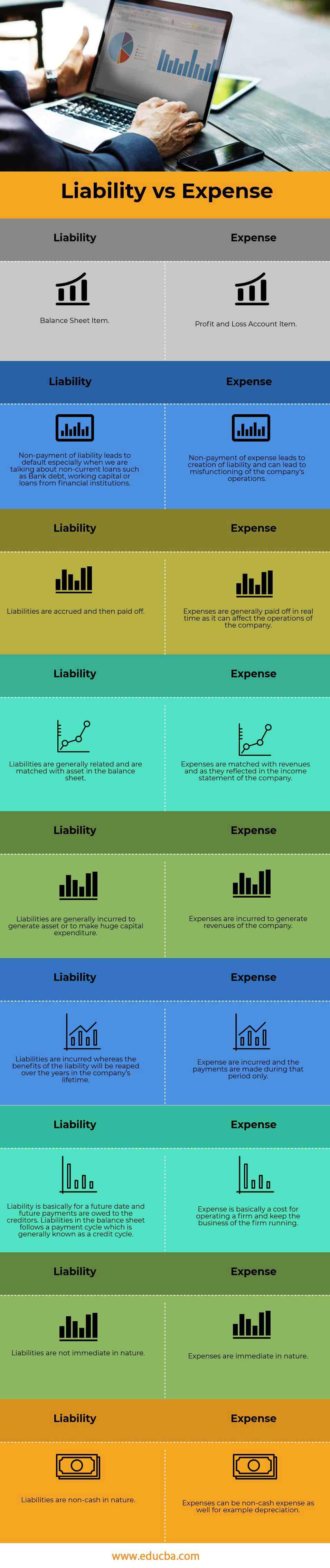

Liability Vs Expense 9 Best Differences To Learn With Infographics

Overhead Expense Role In Cost Accounting And Business Strategy

How To Pay Little To No Taxes For The Rest Of Your Life

How Do Operating Income And Revenue Differ

Small Business Annual Sales How Much Money Do They Make

What Is Cost Of Goods Sold Cogs And How To Calculate It

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

Does Gross Profit Include Labor And Overhead

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Free Small Business Budget Templates Smartsheet

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Post a Comment for "Business Expenses Higher Than Income"