Llc Tax Filing Deadline 2021 Virginia

On April 15 annual federal taxes are due and typically also in each state. Annual Report Filing Fees.

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

It will also make handling taxes easier.

Llc tax filing deadline 2021 virginia. Virginia Department of Taxation. Companies have until April 15 2021 to submit corporate tax returns for income received in 2020. See How to File and Pay below for payment options.

Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021. Ralph Northam announced Friday that the state Department of Taxation is extending the original May 1. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

Quarterly tax due dates. For more information about filing your return this year see Avoid Pandemic Paper Delays. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021.

However the filing deadline for 2020 individual income tax returns has been extended to Monday May 17 2021. Businesses may use Form 1120 or request a six-month extension by filing Form 7004 and submitting a deposit for the amount of estimated tax owed. S corporation returns on Form 1120 S.

Taxpayers have until June 30 2021 to make 2020 IRA contributions. Virginia Limited Liability Companies. Partnership tax returns on Form 1065.

NEW INDIVIDUAL INCOME TAX FILING AND PAYMENT DEADLINE. C Corps file IRS Form 1120 US. The number of the form relates to the applicable statute in Title 131 of the Code of Virginia.

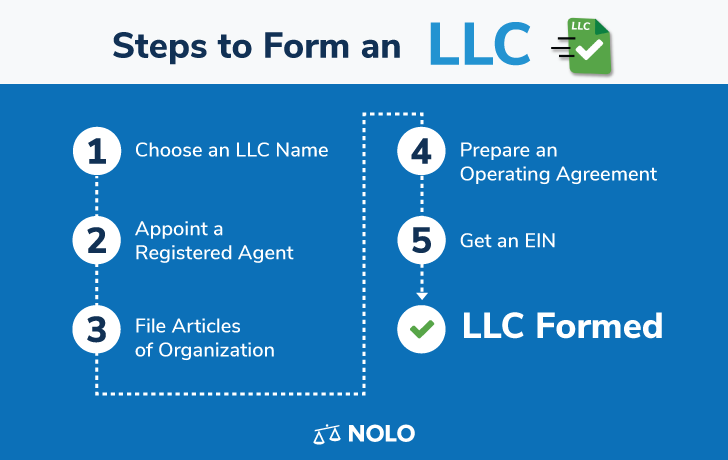

Virginia is giving taxpayers a few more weeks to file their state income tax returns. When forming an LLC or limited liability company there are certain steps that need to be taken on a continuous basis in order to keep the business compliant with the lawThe steps will also give the owners of the company limited liability. You must apply for a tax extension no later than your typical tax deadline.

Multiple-member LLC returns filing partnership returns on Form 1065. Tips for Filing Season. 8043678037 To purchase Virginia Package X copies of annual forms complete and mail the Package X order form.

Corporations are required to file and pay all annual income tax returns estimated payments and extension payments electronically. A Limited Liability Company LLC is an entity created by state statute. Sole proprietorship and single-member LLC tax returns on Schedule C with the owners personal tax return.

Its important to remember that nonprofits can only file one extension per year. Corporation Income Tax Return the deadline being April 15 2021 for corporations operating on a calendar year the extended deadline is October 15 2021. On March 19 2021 Governor Northam announced that Virginia would move the Taxable Year 2020 individual income tax filing and payment deadline for calendar year filers from May 1 2021.

All forms for Virginia Limited Liability Companies are eligible for online filing. For C Corps not using a calendar year the filing deadline is the 15th day of the fourth month following the end of the corporations fiscal year. Schedule K-1s for partners in partnerships LLC members and S corporation shareholders on their personal tax returns.

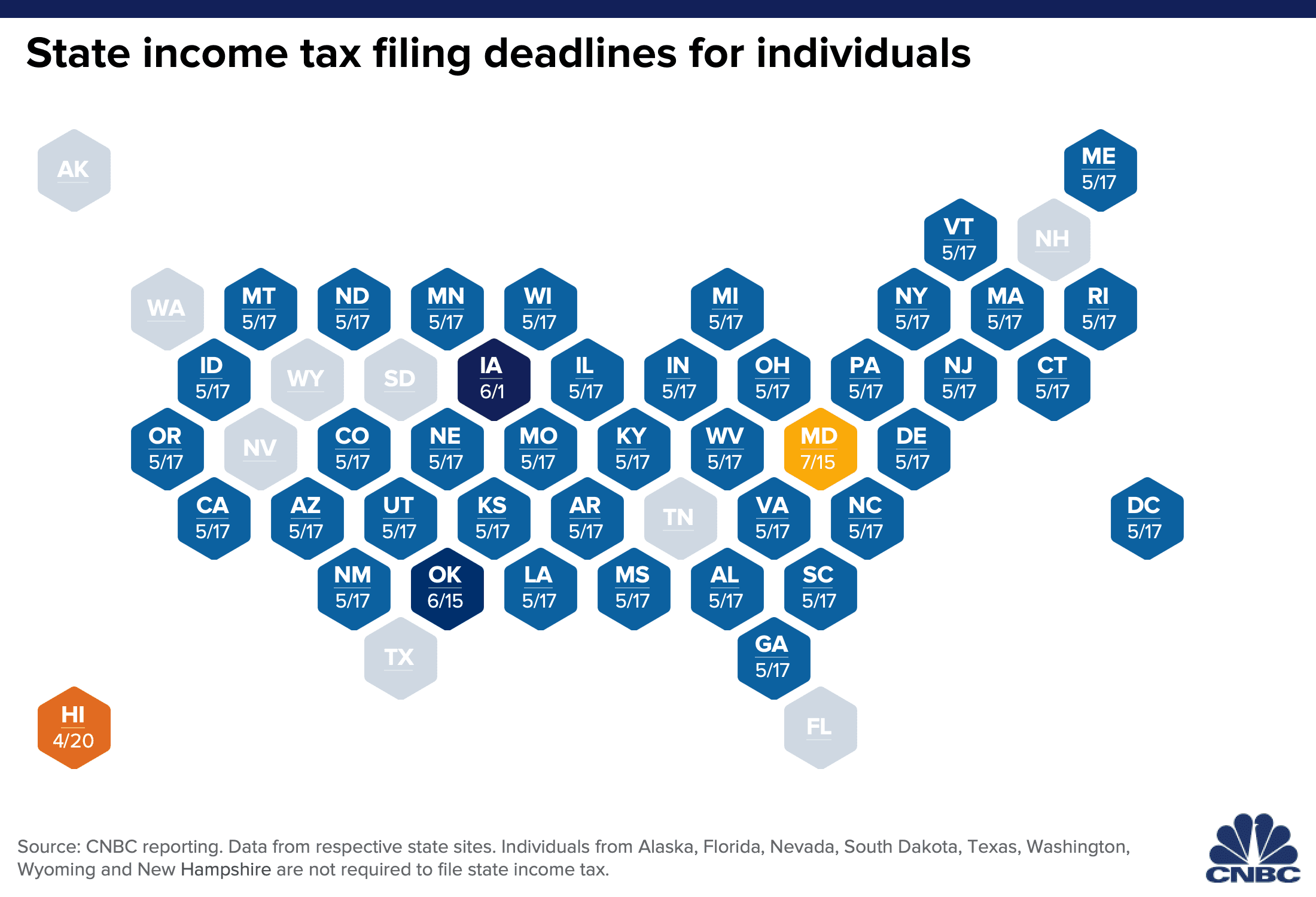

Generally states follow federal guidelines for tax due dates. Visit the Clerks Information System CIS to file business forms online. Here are key tax filing dates to remember for 2021.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. According to Tax Bulletin 21-5 the Virginia Department of Taxation will waive interest and penalties on individual income tax payments due for Taxable Year 2020 that are made in full by the extended due date of May 17 2021. All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online.

If you file Form 8868 for your June 15 2021 deadline your new due date will be December 15 2021. Check with your states Department of Revenue for additional deadlines. The individual income tax filing and payment deadline in Virginia is extended to Monday May 17 2021.

Knowing the Virginia LLC tax rules will keep a company in good standing with the law. The first quarterly estimated tax payment of the year is also due on this date. If the due date falls on a Saturday Sunday or holiday you have.

Returns are due the 15th day of the 4th month after the close of your fiscal year. If you need to order forms call Customer Services. When you file Form 8868 your organization can receive an automatic extension of up to six months.

Failure to file the report and pay the required franchise taxes will result in a penalty of 20000 plus 15 interest per month on tax and penalty. IMPORTANT INFORMATION REGARDING CERTAIN FILING AND PAYMENT DEADLINES. Certain deadlines falling on or after February 27 2021 and before June 30 2021 are postponed through June 30 2021 including the deadlines for filing individual income tax returns and making payments of tax.

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Llc In Virginia How To Start An Llc In Virginia Nolo

Tax Preparer Accountant Business Card Zazzle Com In 2021 Tax Preparation Successful Home Business High Quality Business Cards

Business Tax Timeline Annual Vs Quarterly Filing Synovus

What Business Owners Need To Know About Filing Taxes In 2021

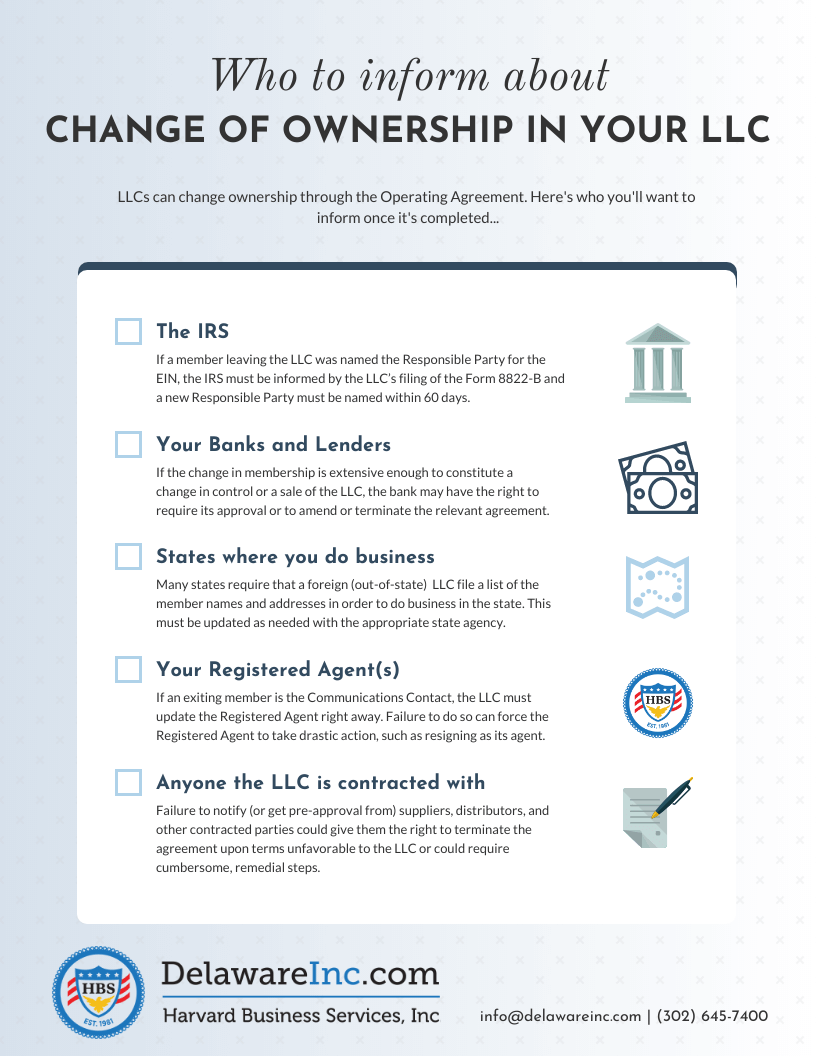

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Federal And State Tax Filing Deadlines Extended

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Start An Llc In Pennsylvania 37 Nw Registered Agent

How To File An Extension For Taxes Form 4868 H R Block

Irs And Many States Announce Tax Filing Extension For 2020 Returns

2021 Taxes A Comprehensive Guide To Filing Money

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

Irs And Many States Announce Tax Filing Extension For 2020 Returns

When Are Taxes Due For An Llc Legalzoom Com

Post a Comment for "Llc Tax Filing Deadline 2021 Virginia"