Business Cash Receipts Journal Meaning

Join PRO or PRO Plus and Get. As such having cash receipts and proper filing will avoid the risk of audit issues.

Cash Receipt Accountingtools Simple Accounting

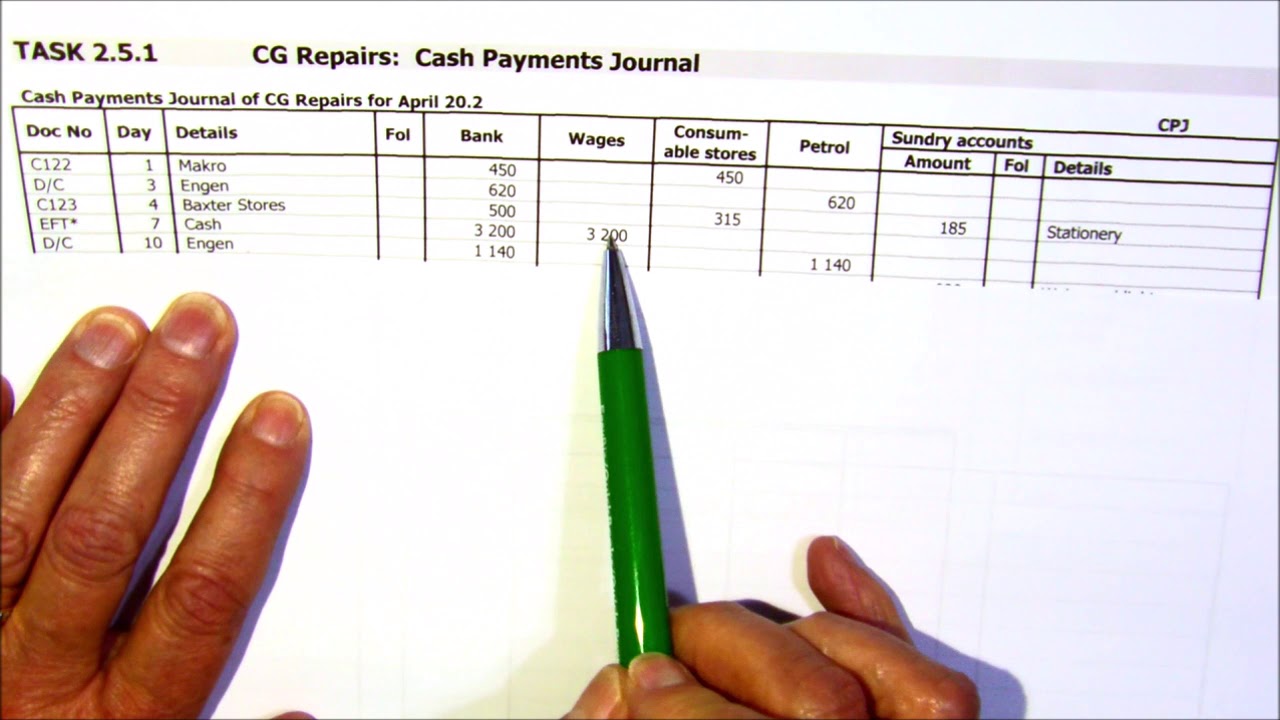

43 A book to record transactions where money is taken OUT of the business bank account.

Business cash receipts journal meaning. Record the following. Do you want to know how to manually process customer payments in Business Central. In a manual system this will allow one entry to the Cash account for the month or shorter periods instead of debiting the Cash account for every receipt.

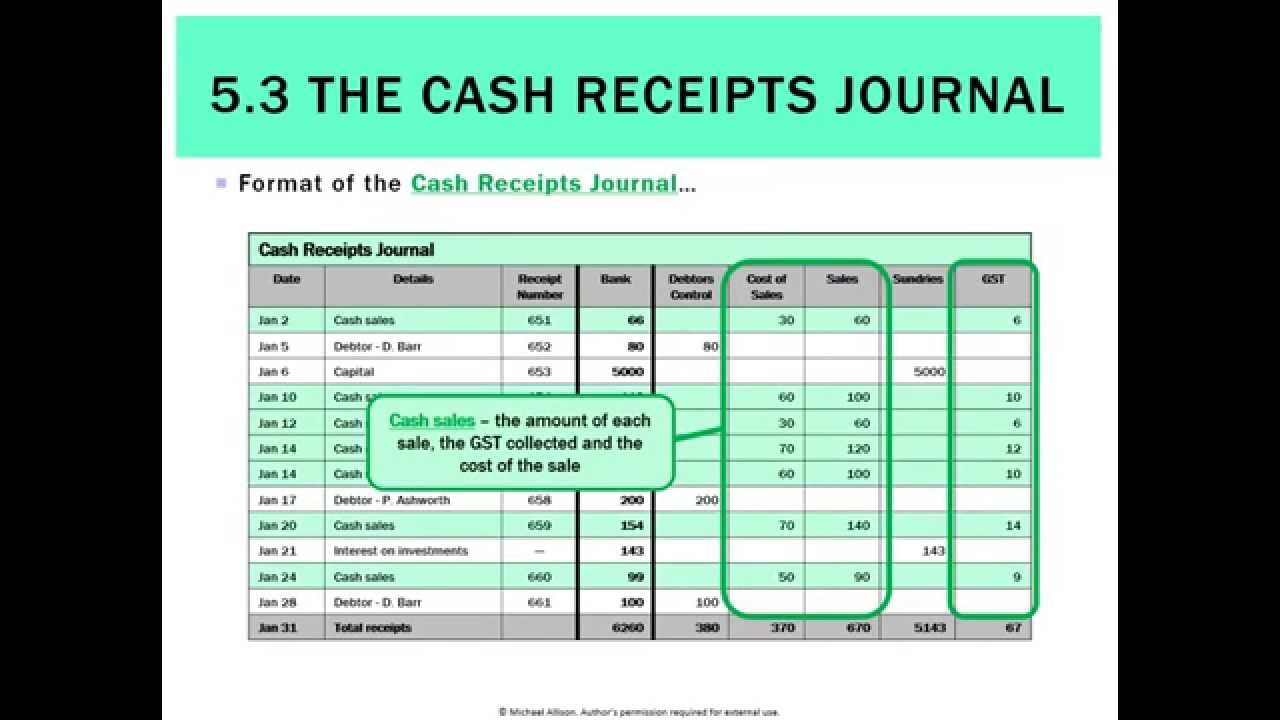

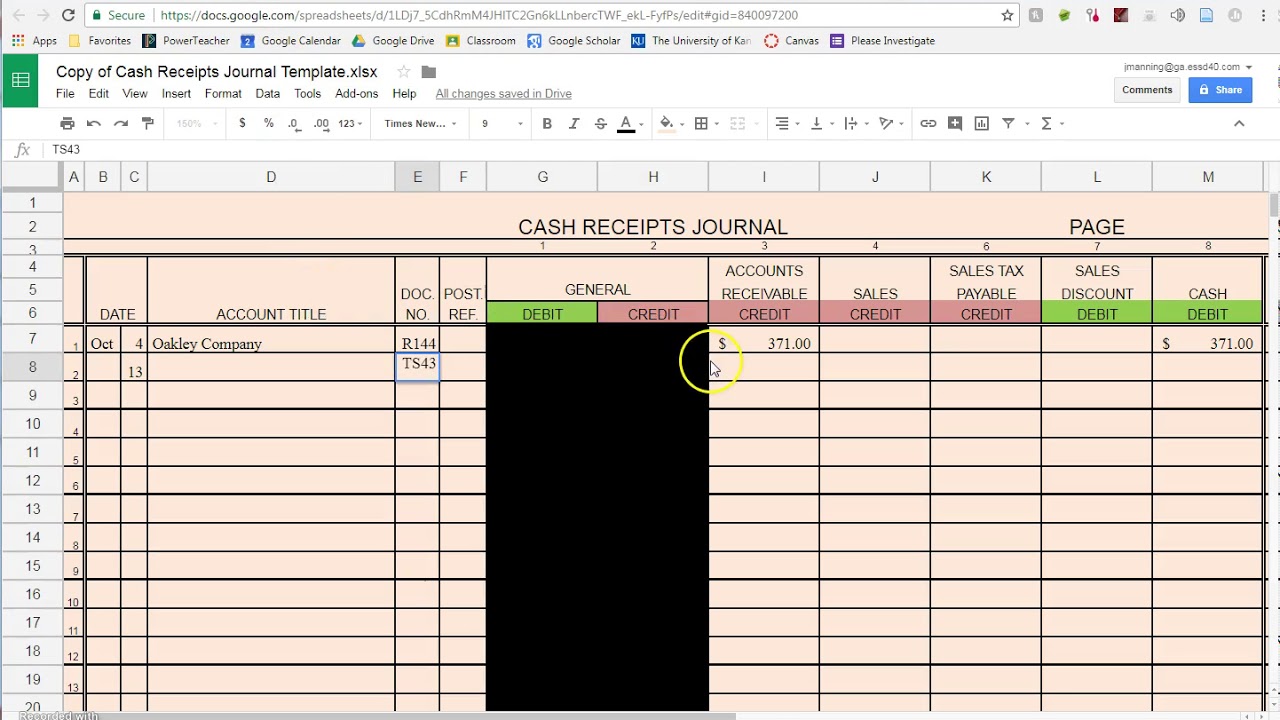

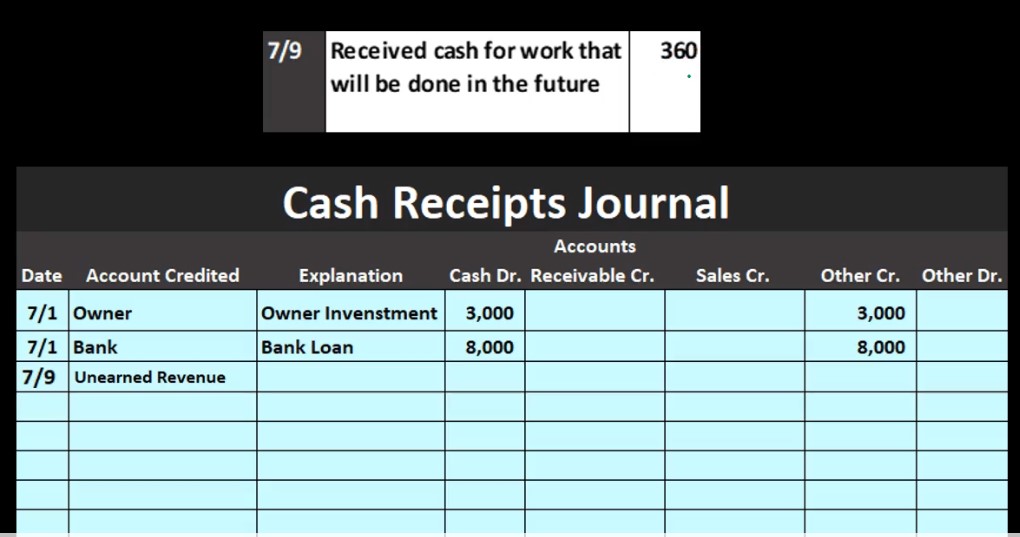

Your cash receipts journal manages all cash inflows for your business. One of the journals is a cash receipts journal a record of all of the cash that a business takes in. Record all of your incoming cash in your journal.

It is reserved specifically for activities that involve receiving cash. For example if you paid cash to any of your. A cash disbursement journal is a record of a companys internal accounts that itemizes all financial expenditures made with cash or cash equivalents.

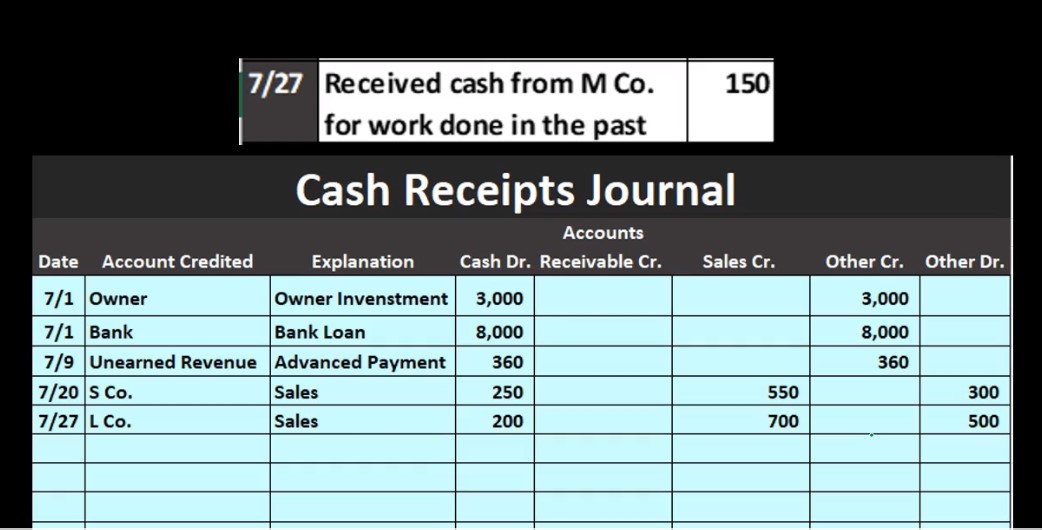

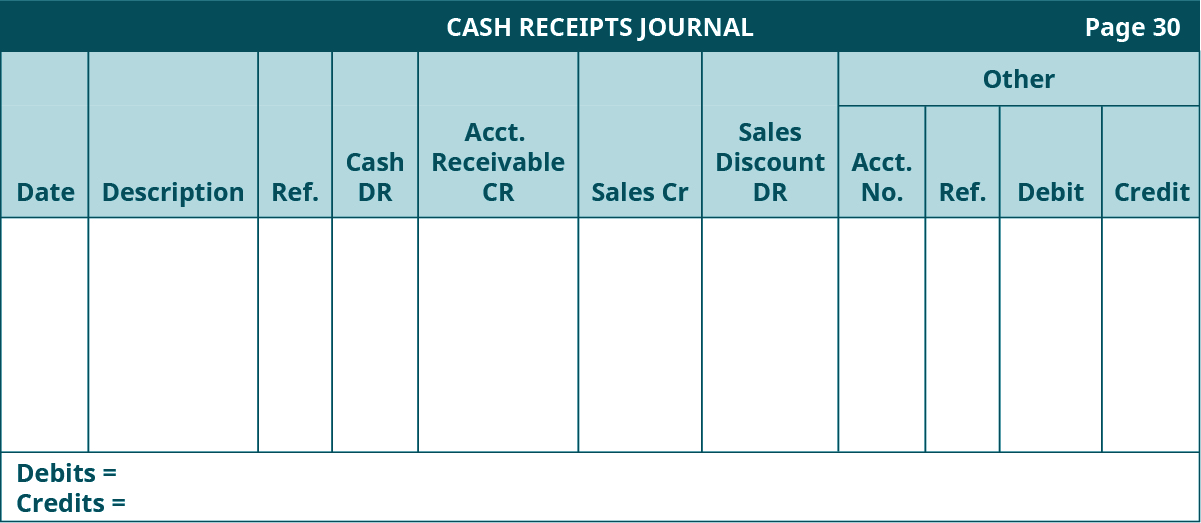

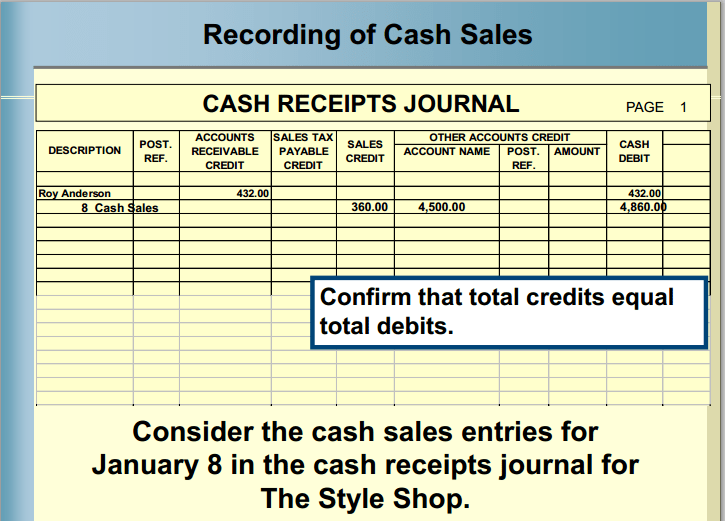

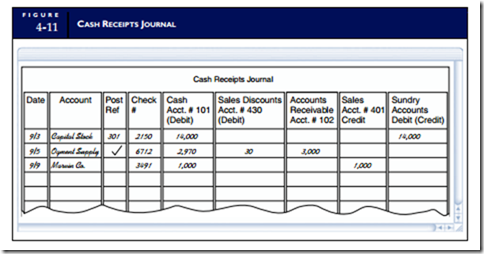

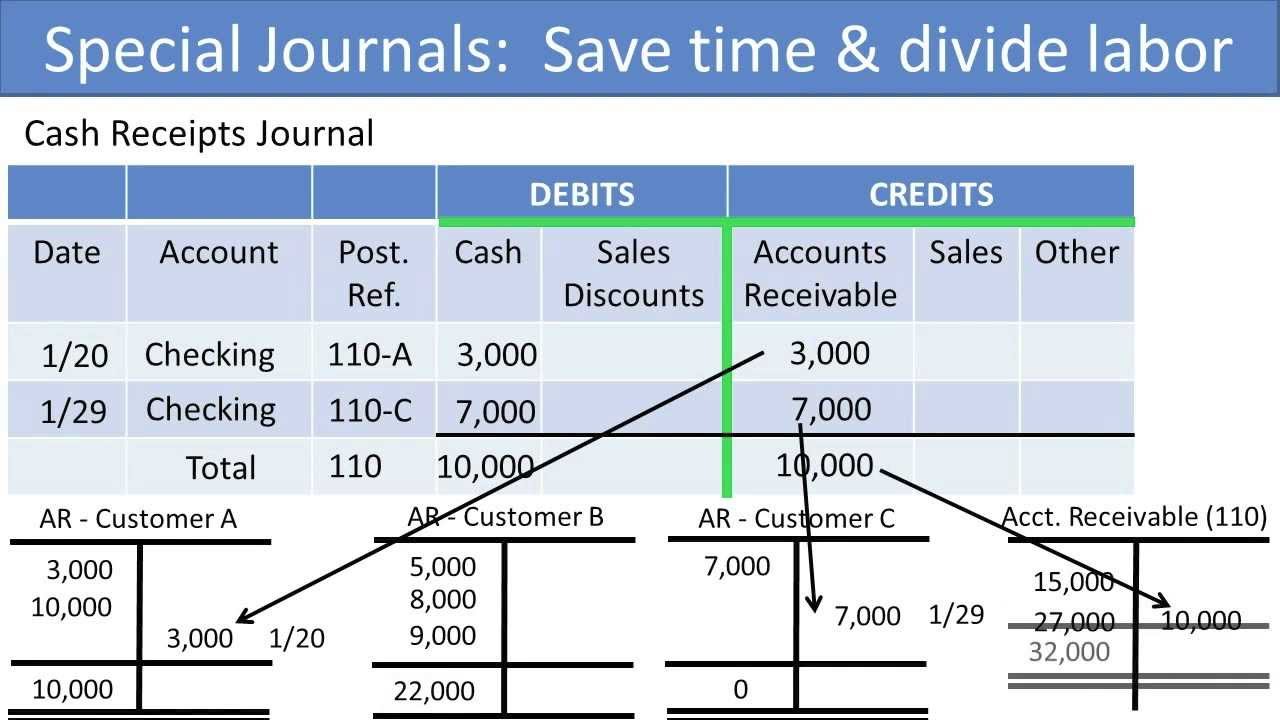

The cash receipts journal manages all cash inflows of a business organization. For recording all cash outflows another journal known as cash disbursements journal or cash payments journal is used. The cash receipts journal is a special section of the general journal specifically used to record all receipts of cash.

The major sources of cash receipt in a business are as follows. The cash receipts journal is a special journal used to record the receipt of cash by a business. Investment of capital by the proprietor owner.

In other words the cash receipts journal is a separate journal only used to record cash collections. Your cash receipts journal typically includes cash sales and credit categories. In your journal you will want to record.

This module will focus on how to enter payments manually in the cash receipt journal and payment journal and it will also explain how to apply payments. 44 Cheques and a bank statement. Definition Cash receipt journal is a special journal that is used for the purpose of recording cash received by a business from any source.

Cash payment journal or cash disbursement journal is used to record all cash payments made by the business. A cash disbursement journal is done before. If so then this module is for you.

A cash receipt also becomes important because one of the major reason for an audit is the lack of documents such as cash receipts to support the existence of the transaction. Or The special journal used to record cash disbursements made by check is called a cash payment journal. In simple words Cash Receipts Journal can be defined as a section which is special for a general journal and they are mainly used to maintain a record of all the receipts of cash.

One of the journals is a cash receipts journal a record of all of the cash. What Does Cash Receipts Journal Mean. You may sell items or provide services that people pay for with cash which may range from food or books to massages or even a ride in a taxicab.

The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with. 41 Cash Payment Journal CPJ 42 Cash payment journal of CURLY HAIR SALON for August 2017. Cash receipts journal definition A special journal or specialized journal used to record money received.

45 It is the name of the person to whom the business is paying money or a cash cheque. A cash payment journal is a special journal that allows you to record all cash payments - that is all transactions during which you spend funds. Cash Receipts Journal In accounting journals are used to record similar activities and to keep transactions organized.

The cash receipts journal is that type of accounting journal which is only used to record all receipts of cash during an accounting period and works on the golden rule of accounting debit what comes in and credits what goes out. In other words this journal is used to record all cash coming into the business. They are also known as a subsidiary ledger which is used to record sales and they also.

Accounting Journals The Books Of First Entry

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

Cash Receipts Journal Personal Accounting

Cash Receipts Journal Definition Examples Video Lesson Transcript Study Com

Post A Cash Receipts Journal To A General Ledger Simple Accounting

5 3 The Cash Receipts Journal Youtube

Recording Transactions Into A Cash Receipts Journal Youtube

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Cash Disbursement Journal Double Entry Bookkeeping

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Accounting Journals The Books Of First Entry

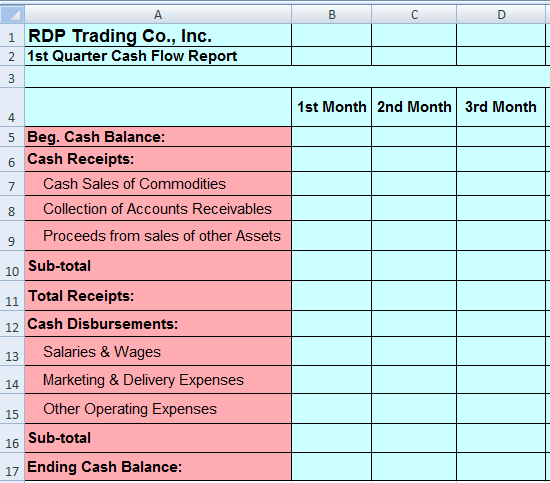

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Bookkeeping Business Accounting Basics

Accounting Journals The Books Of First Entry

Special Journals Financial Accounting

Receipts And Adjustments Journal

A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books

Post a Comment for "Business Cash Receipts Journal Meaning"