How To Calculate Unrelated Business Taxable Income

If the investor qualified for a business. 6 Form 990-W Estimated Tax on Unrelated Business Taxable.

When Partnerships Include Exempt Organizations Dallas Business Income Tax Services

Form 990-W is a worksheet provided by the IRS to determine the amount of estimated tax payments required.

How to calculate unrelated business taxable income. Income generated from eligible taxable activities are subject to an estimated tax of up to 37 on income over 12750 as of 2019. How Does Unrelated Business Taxable Income UBTI Work. Section 512 a 6 of the Internal Revenue Code enacted as part of the tax reform package commonly known as the Tax Cuts and Jobs Act in December 2017 requires a tax-exempt organization to compute UBTI separately with respect to each unrelated trade or business.

An organization must pay estimated tax if it expects its tax for the year to be 500 or more. The Act added Section 512 a 6 to the Internal Revenue Code requiring that UBTI from each unrelated trade or businesses be calculated separately. The Tax Cuts and Jobs Act changed the way tax-exempt organizations calculate their unrelated business taxable income UBTI.

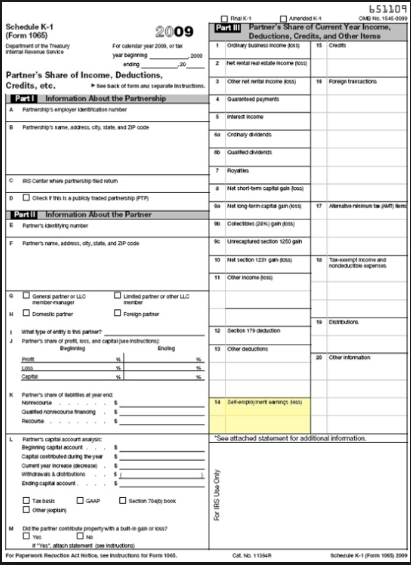

Section 512a6 of the Internal Revenue Code was enacted as part of the Tax Cuts and Jobs Act TCJA in December 2017 and stated that tax-exempt organizations were required to calculate their UBIT unrelated business income tax separately for each unrelated business activity that they engage in and that losses generated by one activity could no longer be used to offset income from. Section 512a6 requires an organization that regularly carries on two or more unrelated business activities to calculate its unrelated business taxable income including for purposes of determining any net operating loss deduction separately with respect to each such trade or business. A 990-T is the additional form required when the IRA generates more than 1000 or more of Gross Income from the unrelated business activity.

UBTI is income from a trade or business regularly carried on. The IRS posted an advance copy of final regulations that provide guidance on how an exempt organization subject to the unrelated business income tax UBIT determines if it has more than one unrelated trade or business TD. No longer can organizations follow the rules used by taxable entities and aggregate income and deductions from all of their unrelated trades or businesses.

The regulations also discuss how an exempt organization calculates unrelated business taxable income UBTI if it has more than one unrelated trade or business. Any investment income a covered entity earns during the taxable year is subject to unrelated business income tax UBIT to the extent the covered entitys year-end assets exceed the account limit. The 1000 specific exemption reduces taxable UBTI by up to that amount.

Internal Revenue Code IRC Section 501 grants tax exempt status to a variety of tax-exempt and mutually beneficial organizations. On April 23 2020 the Department of the Treasury and Internal Revenue Service released long-awaited proposed regulations REG-106864-18 providing guidance on the unrelated business taxable income UBTI silo rule. UBTI was enacted in 1950 to ensure that tax- exempt entities do not unfairly compete with taxable companies in profit-generating activities.

One of the provisions of the Tax Cuts and Jobs Act Act that has raised significant questions and concerns for exempt organizations is the calculation of unrelated business taxable income UBTI. Rather new code section 512 a 6 requires organizations to separately compute their UBTI for each. The obligation to file Form 990-T is in addition to the obligation to file the annual information return Form 990 990-EZ or 990-PF.

An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF. To the extent an exempt organization has gross income defined as gross receipts less cost of goods sold of more than 1000 from a regularly conducted unrelated trade or business it must file Form 990-T Exempt Organization Business Income Tax Return to report and pay income tax on its UBTI. The total amount of investment income earned during the year should be considered when calculating whether an excess exists at the end of the year.

For example if an investor uses his Individual Retirement Account IRA open a bakery this is a business clearly not related to the primary purpose of an IRAThe income from the bakery is considered UBTI and is taxable even though the money is flowing into a tax-advantaged account. See irsgov Internal Revenue Service.

Pinterest George M Cohan George Pinterest Cards Against Humanity

Understanding Unrelated Business Taxable Income Ubti In An Ira Strata Trust Company

Mlps And K 1s And Ubti Oh My Seeking Alpha

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit

Much Money You Will Find In Your Bank Account At The End Of 3 Years Simply Copy The Same Formula Compound Interest Interest Calculator Excel Formula

Ubit Unrelated Business Income Tax Common Questions 990 T Resources

Unrelated Business Taxable Income Silo Rules Clarified At Last Kpm

Net Operating Losses And Unrelated Business Taxable Income Hawkins Ash Cpas

Federal Income Tax Deadlines In 2021 Tax Deadline Income Tax Deadline Federal Income Tax

Ubit Unrelated Business Income Tax Common Questions 990 T Resources

Ubit Unrelated Business Income Tax Common Questions 990 T Resources

What Is Ubit Unrelated Business Income Tax

Taxable Income Formula Calculator Examples With Excel Template

What To Do When An Ira Owned Asset Generates Unrelated Business Taxable Income Ubti Strata Trust Company

Understanding Unrelated Business Taxable Income Ubti In An Ira Strata Trust Company

Ubit Unrelated Business Income Tax Common Questions 990 T Resources

Https Www Nais Org Media Nais Articles Documents Nais Ubit Comments Pdf

Irs Issues Proposed Regulations On Grouping Activities In Calculating Unrelated Business Taxable Income

Post a Comment for "How To Calculate Unrelated Business Taxable Income"