Business Tax Deadline 2021 Llc

People and corporations affected by the California wildfires who had a valid extension to file their 2019 tax returns by October 15 2020 now have until January 15 2021 to file their returns. The best tax treatment option maximizes your tax savings when you file your small business taxes.

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

A Limited Liability Company LLC is an entity created by state statute.

Business tax deadline 2021 llc. May 17 2021 Partnership tax returns on Form 1065. Return and Payment Due Dates. LLCs taxed as partnerships should file Form 1065 by March 15 2020 on a calendar tax year.

For those affected by Hurricane Delta with valid extensions to file by October 15 may file their returns by February 16 2021. Use LLC Tax Voucher 3522 when making your payment and to figure out your due date. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Here are the tax return due dates for small business taxes. How single-owner LLCs are taxed Single-owner LLCs are 100 owned by one person or depending on. The resources below are for businesses taxpayers looking to obtain information on filing and paying Ohio taxes registering a business and other services provided by the Department.

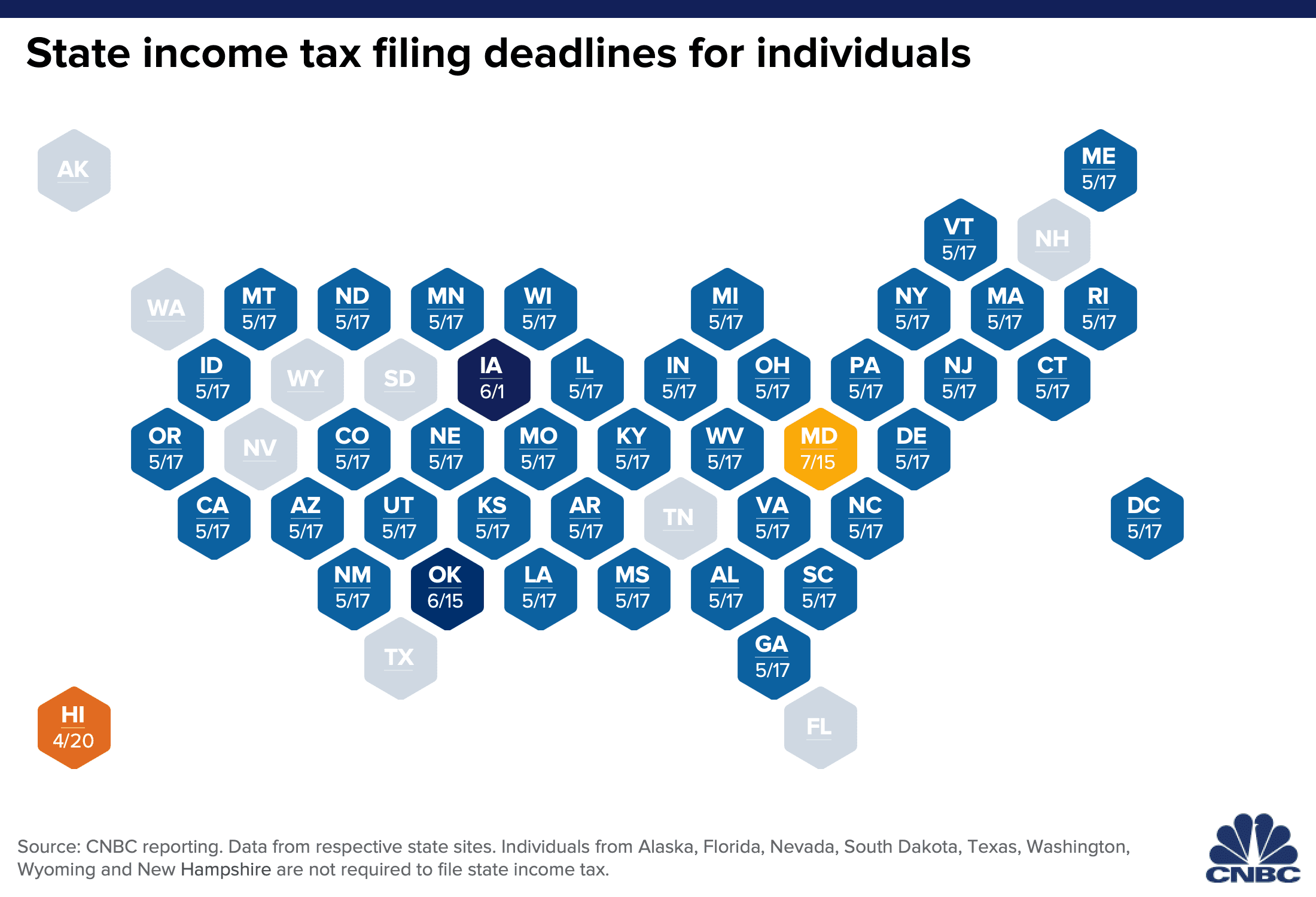

File Your Business Taxes Online. Tax Deadlines Changed The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021. The April 2021 sales tax return which is normally due on May 23rd is due May 24th 2021 since the 23rd falls on Sunday.

19 hours agoThe June 15 2021 deadline applies to the first quarter estimated tax payment due on April 15. If a due date falls on a weekend or holiday the due date is the next business dayFor example. The amount will be based on total income from California sources.

Companies have until April 15 2021 to submit corporate tax returns for income received in 2020. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. It also applies to the quarterly payroll and excise tax returns normally due on April 30 2021.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month. LLC taxes due in 2020 Plus members of LLCs taxed as disregarded entities should file Form 1040 by April 15 2020.

The first quarterly estimated tax payment of the year is also due on this date. Youre required to pay an annual fee. Due Dates Interest Rates Voluntary Disclosure Program Taxpayer Representation Form TBOR 1.

You form a new LLC and register with SOS on June 18 2020. So if a majority use a calendar year then the LLCs taxes are due on March 15. If the members use a fiscal year ending March 30 as in the example above July 15 is the deadline.

Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments. Businesses may use Form 1120 or request a six-month extension by filing Form 7004 and submitting a deposit for the amount of estimated tax owed. 15th day of the 4th month after the beginning of your tax year.

Sole proprietorship and single-member LLC tax returns on Schedule C with the owners personal tax return. Visit the LLC Fee chart to figure your fee amount. Or file it by the 15th of the third month after.

Tax information tools and resources for businesses. Your tax accounting calendar should be the one used by the members who own a majority interest in the LLC.

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Extension Filers Deadline Approaches Taxes Humor Tax Return Filer

Tick Tock Goes The Clock 19 More Days Until The Irs Tax Extension Deadline Is Here Call Providence For Help Not Much Ti Irs Taxes Tax Extension Tax Services

Small Business Tax Preparation Checklist 2021 Quickbooks

Us Tax Deadlines Updated For Expats Businesses Online Taxman

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Federal Income Tax Deadlines In 2021 Tax Deadline Income Tax Deadline Federal Income Tax

Small Business Accounting Cheat Sheet Important Info Small Business Accounting Business Tax Small Business Tax

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

2021 Tax Calendar For Small Business Owners Godaddy Blog

What Are The 2021 Tax Deadlines And Extensions For American Expats Tax Deadline Filing Taxes Expat

How To File An Extension For Taxes Form 4868 H R Block

This Is Your Reminder Only 34 Days Until The Irs Tax Extension Deadline Is Here No Time To Procrastinate Call Us If You Tax Extension Irs Taxes Tax Services

Small Business Tax Preparation Checklist 2021 Quickbooks

When Are Business Taxes Due In 2018 Every Date You Need To File Your 2017 Tax Return Indinero

Post a Comment for "Business Tax Deadline 2021 Llc"