Corporate Tax Id Ontario

The Ontario tax rate for corporations is 115. The tax rates apply to taxable income allocated to Ontario.

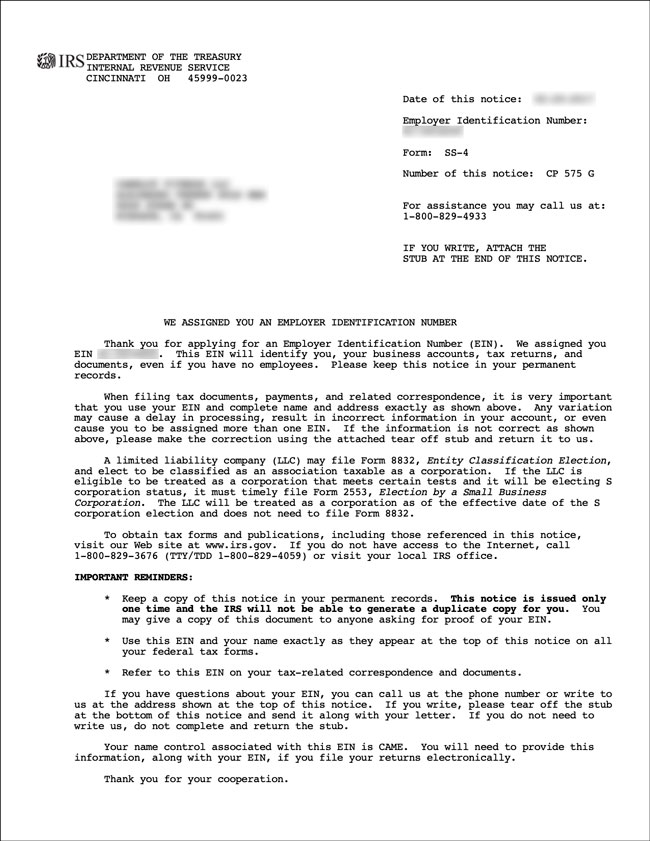

How To Apply For Ein For Your Llc Without An Ssn Or Itin Llc University

The balance of tax the corporation owes for a tax year is due within either two or three months of the end of that tax year depending on the circumstances of the corporation.

Corporate tax id ontario. Certain business activities require a business number. Search by Business Number BN Enter the first nine-digit of the fifteen-digit Business Number BN that was assigned to the federal body corporate by the Canada Revenue Agency CRA. If you need your BN before you receive the confirmation notice call us at 1-800-959-5525.

Have a copy of your certificate of incorporation on hand because we may ask you for it. Corporations have to pay corporate income tax in monthly or quarterly instalments when the total of the taxes payable for either the previous year or the current year is more than 3000. A tax identification number or TIN is an ID number the IRS uses to administer tax laws.

Ontario Corporation Number OCN or Business Identification Number BIN Accurate spelling of the corporations name the business name limited partnership or the corporations operating name CPVSB recommends that clients conduct both corporate and BNLP Enhanced Business Name searches when they are uncertain as to whether the name belongs to a corporation. For corporations that are filed manually the corporate number is located in the top right hand corner of the first page of Articles of Incorporation. The lower rate is currently 32.

Your corporation income tax program account will include the letters RC and a four-digit reference number. Federal Tax Id Number also called an Employer Identification Number or EIN State Tax Id Number also called an Employer Identification Number or EIN or Ontario Sales Tax ID number also called a reseller number resale number sellers number wholesale retail or resale certificate. Payroll Account Set up.

For corporations their tax identification number is their nine-digit Business Number BN issued by the Canada Revenue Agency CRA. Information on the BN including how to apply for one is available from the Business Number BN. This is a sample from Ontario Incorporation documents.

Corporation income tax program account. The net tax rate for Canadian-controlled private corporations that claim the. Canada Revenue Agency CRA program accounts.

You can register for. Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency CRA. It is unique to your organization and is used when dealing with the federal government and certain provincial governments.

The Ontario General corporate income tax rate is. The lower Ontario rate applies to profits from manufacturing and processing and from farming mining logging and fishing operations carried on in Canada and allocated to Ontario. As of January 1 2019 the net tax rate after the general tax reduction is fifteen per cent.

The business number is a nine-digit number the Canada Revenue Agency CRA assigns your business or nonprofit as a tax ID. Additional search option - Province of Registered Office. Two letters and four digits attached to a business number and used for specific business activities that must be reported to the CRA.

The purpose is to assign a number to each taxpayer whether thats an individual or a business. Corporations resident in Canada have income tax reporting obligations and are required to have a BN. However the Ontario Small Business Deduction SBD reduces that rate for the first 500000 of income.

A unique 9-digit number and the standard identifier for businesses which is unique to a business or legal entity. Generally corporations carrying on business through a permanent establishment in Ontario are subject to both federal and Ontario corporate income taxes. Corporate Tax ID Set up.

QST Account Set up. Corporations subject to Ontario income tax may also be liable for corporate minimum tax CMT based on adjusted book income. GSTHST Account Set up.

In addition theres a manufacturing and processing tax credit that. Do not enter the last six digits of the BN. PST Account Set up.

When do you have to pay the corporate income tax owing. For corporations that are filed electronically the corporation number is located near the middle of the page under the corporation name. Learn why you might need one and how you could utilize it when accessing various CRA programs.

Usa Ontario Hydro One Electricity Utility Bill Template In Word Format 2 Pages Bill Template Templates Utility Bill

Employer Identification Number Ein For Canadian Companies Madan Ca

A Crafter S Resource Site Drivers License Passport Online Psd Template Downloads

What S My Property S Tax Identification Number

Pin By Sab Auditing Of Accounts On Vat In Uae Digital Tax Accounting Firms Vat In Uae

What S My Property S Tax Identification Number

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

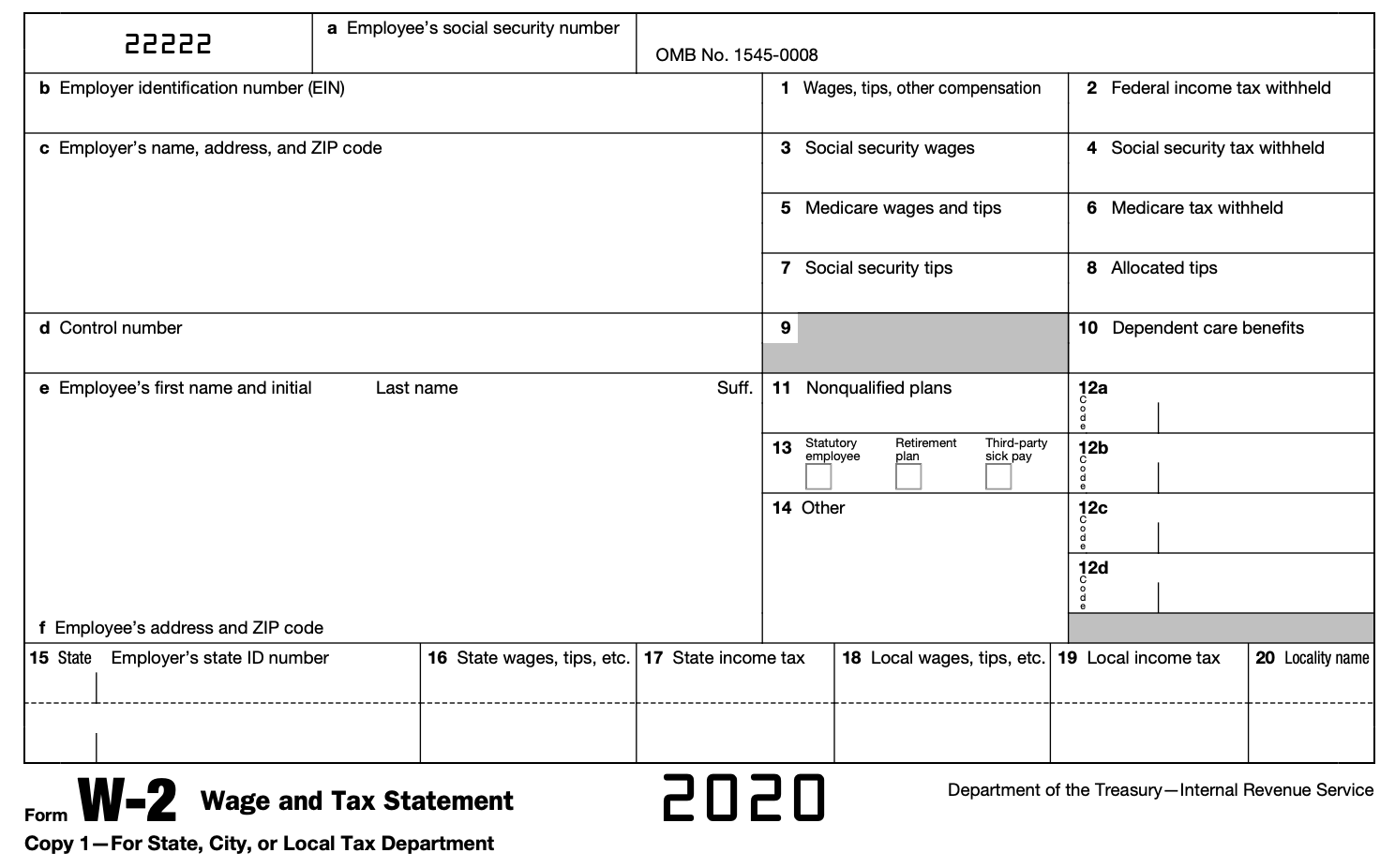

Import Your W2 Form With Turbotax 2020 2021 Turbotax W2 Forms How To Take Photos

Is Your Business Growing Do You Currently Need To Hire Employees Payroll Rancho Cucamonga Call Mr Ste Payroll Grow Business Employer Identification Number

How To Read Your W 2 Justworks Help Center

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Bill Template

Fillable W 4 Form W2s W4s And W9s Facts Financing Employee Tax Forms Tax Forms Business Letter Template

W9 Tax Form 2020 Printable Tax Forms Calendar Template Calendar

Https Www Rbcdirectinvesting Com Pdf Rc521 Guide Pdf

What S My Property S Tax Identification Number

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Post a Comment for "Corporate Tax Id Ontario"