Ohio Business Gateway Commercial Activity Tax

1 2019 - March 31 2019 the taxpayer must pay the. Municipal Net Profit Tax Replacement Tire Fee Other Tobacco Products Tax Motor Fuel Tax Cigarette Tax Master Settlement Agreement Wireless 911 Petroleum Activity Tax International Fuel Tax Agreement Financial Institutions Tax Severance Tax Sales.

Ohio Department Of Taxation S Casino Training Ppt Download

File Unemployment Compensation Tax.

Ohio business gateway commercial activity tax. Taxpayers can register by mail or online through the Ohio Business Gateway. Your tax will be 260000 on the first 100000000 plus 026 percent of the excess. Can I make EFT payments voluntarily.

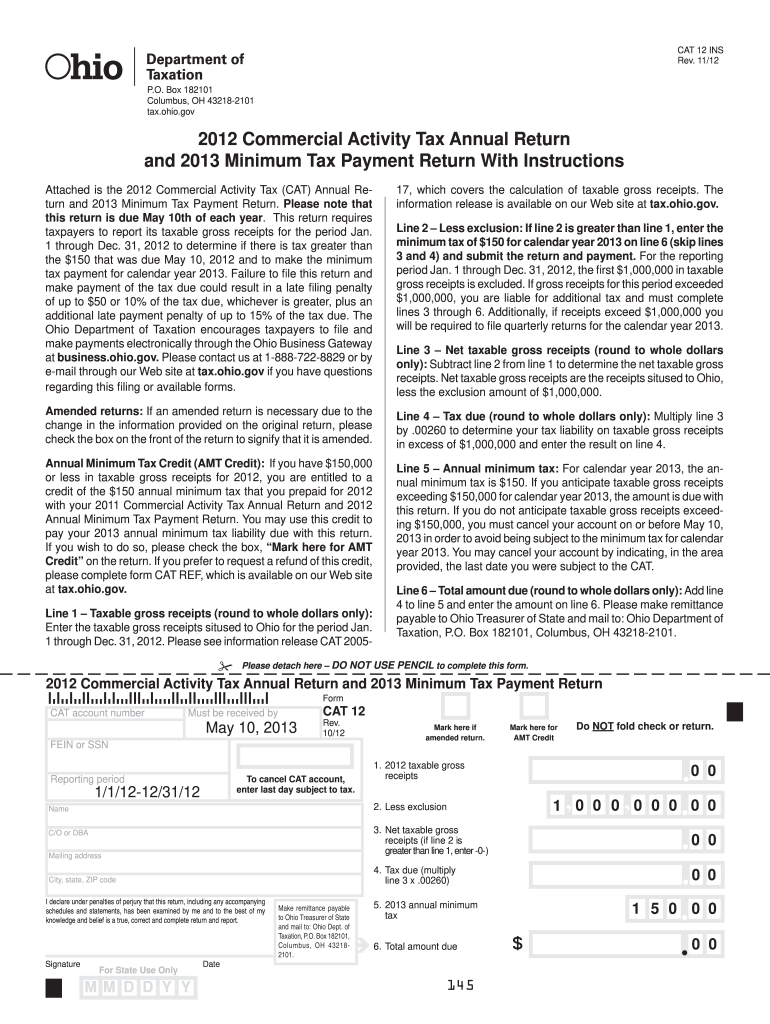

For tax periods prior to December 31 2013 the annual minimum tax AMT is 150. Businesses with Ohio taxable gross receipts of 150000 or more per calendar year must register for the CAT file all the applicable returns and make all corresponding payments. Sales Use Tax.

1 For purposes of the commercial activity tax a group of two or more persons may elect under section 5751011 of the Revised Code to be in a consolidated elected taxpayer group that includes all persons that are at least fifty per cent owned and controlled or at least eighty per cent owned and controlled by common owners. July 1 - Sept. File Your Business Taxes Online.

Do the tax due dates change for EFT payments. The following Gateway Taxation applications will be under maintenance and unavailable on Wednesday 5192021 between 530 PM to 830 PM. Register for a vendors license.

Box 530 Columbus Ohio 43216-0530Ifthetaxpayerfails to provide a copy of the certificate and schedules with its return or if filing electronically a copy to the commissioner the taxpayer must supply a copy of the. Commercial Activity Tax and Petroleum Activity Tax. Your quarterly return must be filed and paid online through the Ohio Business Gateway.

In order to process credit card payments ACI Payments Inc the credit card service provider charges a service fee of 25 or 100 whichever is greater on the amount of the transaction. Just fill out an agreement form and fax or mail it to us. Tax The commercial activity tax CAT is an annual tax imposed on the privilege of doing business in Ohio measured by gross receipts from business activities in Ohio.

Offers businesses the opportunity to pay taxes by telephone over the Internet or via the Ohio Business Gateway. Electronic filers must send a copy of the certificate along with completed schedules to the following address. Register for file and pay Commercial Activity Tax.

The group also may elect to include or exclude all non-United States entities that. If you. Taxpayers are required to pay the annual minimum tax with the 1st quarter payment.

Ohio Department of Taxation Commercial Activity Tax Division - CAT Credits PO. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. File Unemployment Compensation Tax.

Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government. Excise Energy Tax including Public Utility kWh Mcf Severance Motor Fuel IFTA Tire Fee Casino Horse Racing Muni for Electric Light and Local Exchange Telephone Companies and various excise taxes. If the filing due date falls on a weekend or holiday the return is due on the next business day.

The Ohio Commercial Activity Tax a 026 percent tax on business gross receipts above 1 million is a throwback to an earlier era of taxation bringing back a tax type that had been in. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Commercial Activity Tax CAT Employer Withholding.

In cooperation with the State of Ohio ACI Payments Inc. For tax periods beginning on January 1 2014 and thereafter the AMT will become a tiered structure and taxpayers will pay an amount that corresponds with their overall commercial activity. To search for a specific CAT Taxpayer please type the Name of the Business or any portion of the name select the type of search Legal Name or Trade Name then press the Search button.

For example if the reporting period is from Jan. This can be completed online at the Ohio Business Gateway. Yes but only on the Ohio Business Gateway website.

If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past. Municipal Income Tax for Electric Light Companies and Telephone Companies.

Register for file and pay Commercial Activity Tax. Welcome to the Ohio Department of Taxations CAT Registration inquiry web form. File and pay sales tax and use tax.

March 31 2020. You must comply with the same established due dates that are listed on your tax returns as required by the Ohio Department of Taxation. If you will not have employees living in Ohioyou have completed your Ohio registration requirements.

File and pay sales tax and use tax. When searching for a sole proprietor you may need to enter the last name. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income.

Register for a vendors license. If you should have specific business tax questions you may contact the Ohio Department of Taxation at 888-405-4089. Click hereto search the Department of.

Municipal Net Profit Tax.

Https Www Tax Ohio Gov Portals 0 Ohiotaxalert Archivedalerts Catfilingreminder41020 Pdf

Https Www Ohiocpa Com Docs Default Source Advocacy Using The Gateway As A Service Provider Granting Or Denying Service Area Pdf

Commercial Activity Tax Cat General Information Department Of Taxation

Step By Step Guide To Forming An Llc In Ohio Startingyourbusiness Com

Start An Llc In Ohio Free Guide Helpful Resources

Https Www Ohiocpa Com Docs Default Source Advocacy Using The Gateway As A Service Provider Understanding Filing Administrat Pdf

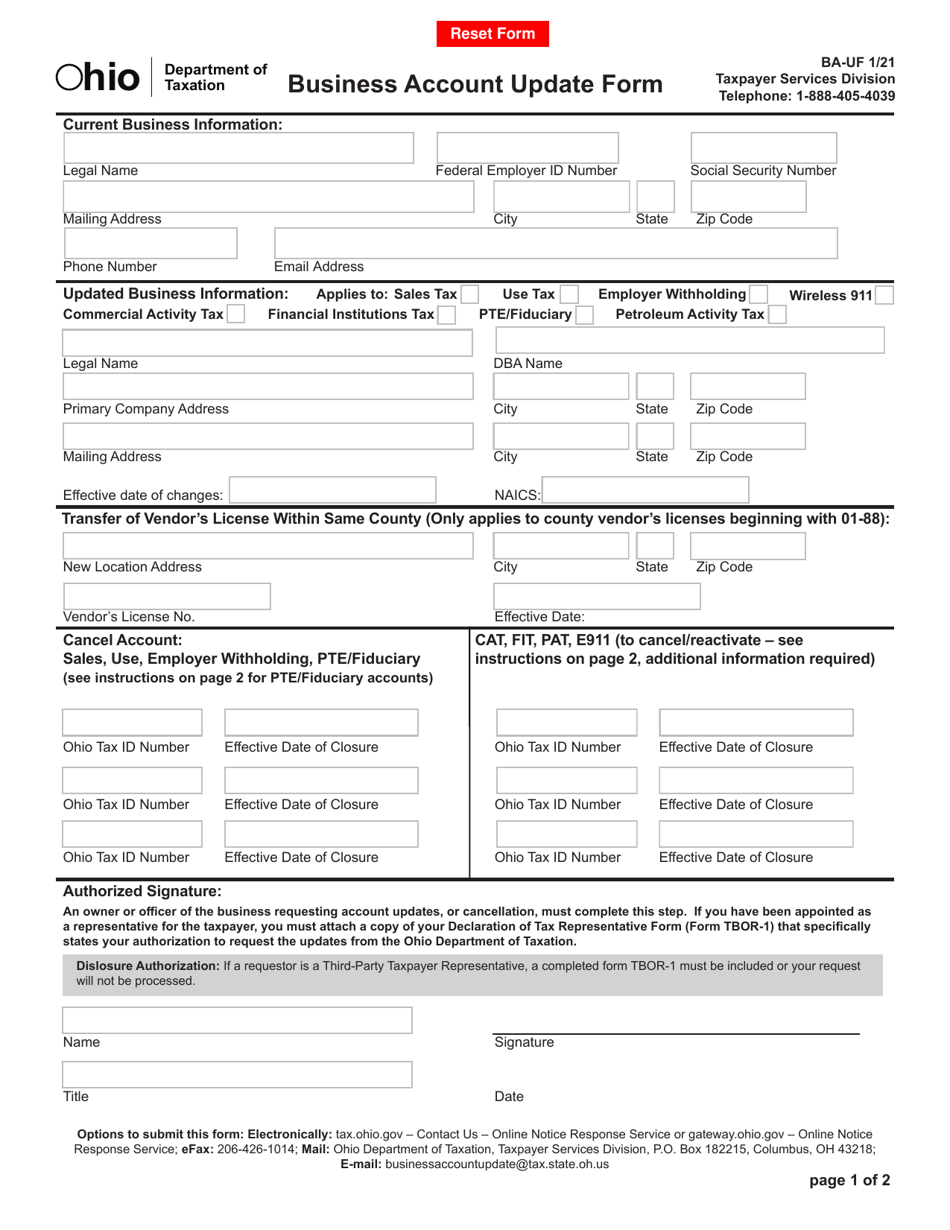

Form Ba Uf Download Fillable Pdf Or Fill Online Business Account Update Form Ohio Templateroller

Businesses Department Of Taxation

Ohio Cat Tax Form 2020 Fill Online Printable Fillable Blank Pdffiller

Https Www Ohiocpa Com Docs Default Source Advocacy Using The Gateway As A Service Provider Granting Or Denying Service Area Pdf

Https Tax Ohio Gov Portals 0 Forms Cat Generic Cat 201 20landing 20page Pdf

Step By Step Guide To Forming An Llc In Ohio Startingyourbusiness Com

Are You Confused By The Commercial Activity Tax Cat

Ohio Cat Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

Ohio Department Of Taxation S Casino Training Ppt Download

Https Www Ohiocpa Com Docs Default Source Advocacy Using The Gateway As A Service Provider Granting Or Denying Service Area Pdf

Incorporate In Ohio Do Business The Right Way

Post a Comment for "Ohio Business Gateway Commercial Activity Tax"