Business Use Of Home Ultratax

Starting in Drake18 use the section Business or Rental Use of Home to enter the percentage of the property used for the business or rental. Scroll down to the Sale of Home section.

Simplified Home Office Deduction

Click Section 14 - Business Use of Home Form 8829.

Business use of home ultratax. Select the home office asset type from the drop-down list and press TAB. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. This is necessary if TP and SP are using separate expenses for separate businesses.

VehicleEmployee Business Expense 2106 - Verify that the Form Screen 30 code 13 and Number of Form Screen 30 code 14 are correct. If you select Home the fields in the Business use of a home and Allowable deductions group boxes become available. This refers to business expenses not specifically related to the home office such as licenses supplies and so forth.

UltraTax CS is a comprehensive tax compliance application that is well suited for larger accounting firms that prepare complicated corporate and partnership returns though the. In the applicable Business Use of Home screen. The conversion program assigns each.

When an entry is made in that field Wks Home is produced in view mode that shows the allocation of the gain andor loss for personal and business use. Standard deduction of 5 per square foot of home used for business maximum 300 square feet. By default the Home Page displays when you open UltraTax CS and you can click the Home Page button on the toolbar.

Check the box 2-year use test met full exclusion If the taxpayer owned and used the home as a main home for 2 or more years during the 5-year period ending on the date of the sale or exchange of the property. Exclusive use means that you use a portion of your home only for business. Change the Activity name or number Screen 29 code 45 to the corresponding business activity prefix number on.

Go to IncomeDeductions Business. The UltraTax CS Home Page provides links to frequently used functions and displays information about return status application updates and client status in UltraTax CS. If there is self-employment income change Form from 0Form 2106 to 1Form 2106Schedule SE.

If you use a room of your home for your business and also for personal purposes you dont meet the exclusive use test. UltraTax CS offers free US. An entry in this field tells the program that the taxpayer qualifies for the full 250000.

Youll access a full line of federal state and local tax programs including 1040 individual 1120 corporate 1065 partnership 1041 estates and trusts and multi-state returns. Based telephone support during regular business hours with extended support hours offered during tax season. Check the box Sale of home MANDATORY to compute exclusion.

For each converted Business Use of Home you must change Form Screen 29 code 45 to the applicable form Schedule C Schedule E Schedule F etc for each home office. If you select Improvements the field in the Improvements group box becomes available. Automate your entire business or professional tax preparation using the powerful timesaving tools included with Thomson Reuters UltraTax CS professional tax software.

These include writing off a portion of utilities mortgage interest depreciation and other expenses directly related to maintaining your home The linked article is advising IRS agents that audit such child care providers on how to scrutinize the business. Amounts in the applicable Business Use of Home screen. However you can set aside a portion of a larger room to be used only for business as long as your personal activities dont stray into it.

IRS Publication 17 Childs Income Elect to Report on Parents Return IRS Publication 17 Childs Income Is Form 8615 Required. Essentially what you might run into is not being allowed business use of home deductions. Business Use of the Home IRS Publication 587 Child and Dependent Care Credit Who Qualifies.

In line 1 - Home number input as needed. Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR. Highlights of the simplified option.

About Form 8829 Expenses for Business Use of Your Home Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of amounts not deductible this year. Allowable home-related itemized deductions claimed in full on Schedule A. In line 1 - Business Name input as needed.

Users can also access support via email or fax or. Select Section 1 - General. In UltraTax CS you will make the designation to use the simplified method within the home office asset.

This is used to calculate allowable expenses under the actual expense method. In lines 2-33 - General information input as needed. See the field help F1 for details.

Https Csqa Thomson Com Ua Ut 2012 Cs Us En Pdfs I Home Pdf

Https Csqa Thomson Com Ua Ut 2012 Cs Us En Pdfs I Home Pdf

Https Csqa Thomson Com Ua Ut 2012 Cs Us En Pdfs I Auto Pdf

Https Csqa Thomson Com Ua Ut 2016 Cs Us En Pdfs I Walk Pdf

Https Www Watsoncpagroup Com Images Pdf Up Taxmanual Pdf

Ultratax Cs Integration Importing Onesource Trusttax Xml Data

Https Www Watsoncpagroup Com Images Pdf Up Taxmanual Pdf

Https Csqa Thomson Com Ua Ut 2012 Cs Us En Pdfs I Home Pdf

Https Csqa Thomson Com Ua Ut 2019 Cs Us En Pdfs I Walk Pdf

Partnerships Ultratax Quickbooks Tax Software Technology Solutions

Walkthrough Ultratax 1040 Tax Year Pdf Free Download

Green Computing Go Green Think Green Green Computing Computer Technology Trends

Ultratax Cs Moving Input Screens Tabs Data Entry Display

Ultratax 1040 Walkthrough Guide Manualzz

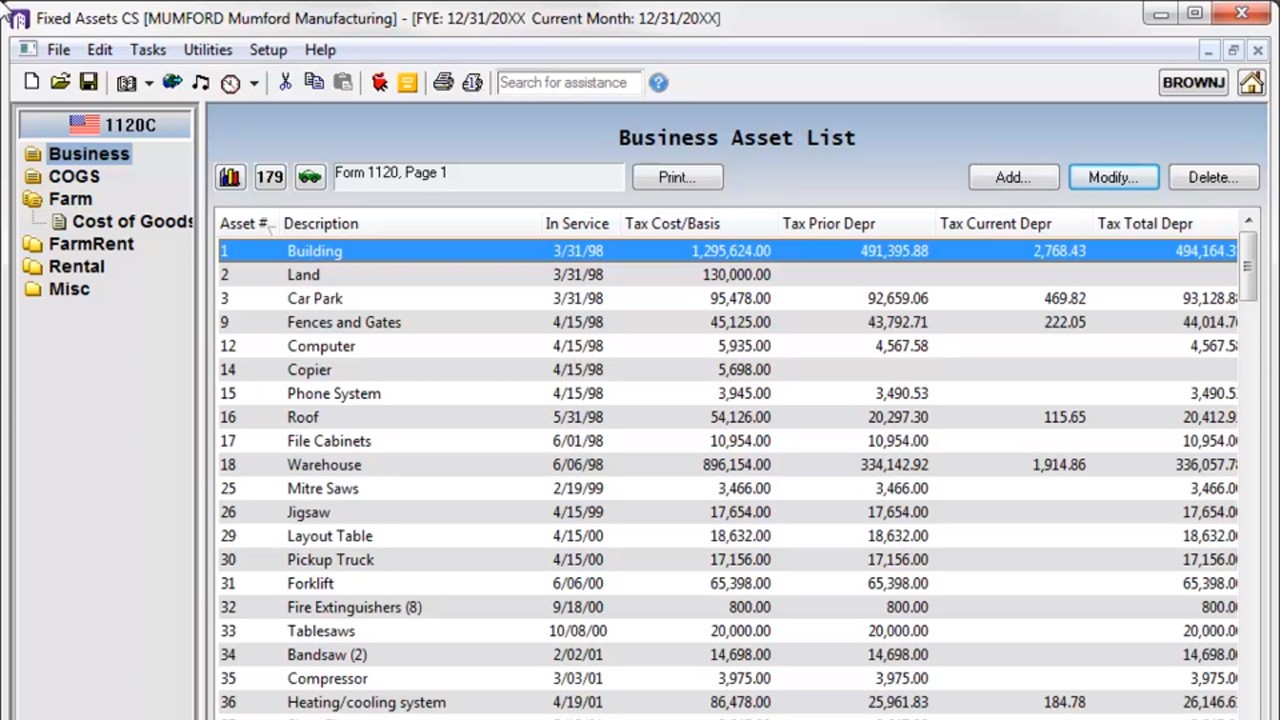

Fixed Asset Depreciation Accounting Software Fixed Assets Cs

Professional Tax Software Thomson Reuters Ultratax Cs Tax Software Software Tax Preparation

Here S How You Can Benefit From Ultratax Cs Hosting Verito Technologies Blog

![]()

Checkpoint Integration With Ultratax Cs

Post a Comment for "Business Use Of Home Ultratax"