S Corp Tax Deadline 2021 Penalty

Expats however always have an. The S Corp Late Filing Penalty Abatement is a waiver that a company can apply for to ask the IRS to reduce or eliminate assessed penalties.

Check Out The List Of All The Important Due Dates With Respect To Gst And Tds For The Month Of February 2 Indirect Tax Goods And Service Tax Important Dates

Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments.

S corp tax deadline 2021 penalty. If tax is due uncommon the penalty is the amount stated above plus 5 of the unpaid tax for each month or part of a month that the return is late up to a maximum of 25 of the unpaid tax. Updated for Tax Year 2020. If your business incorporated as an S Corporation you are probably familiar with the S Corp tax deadline March 15.

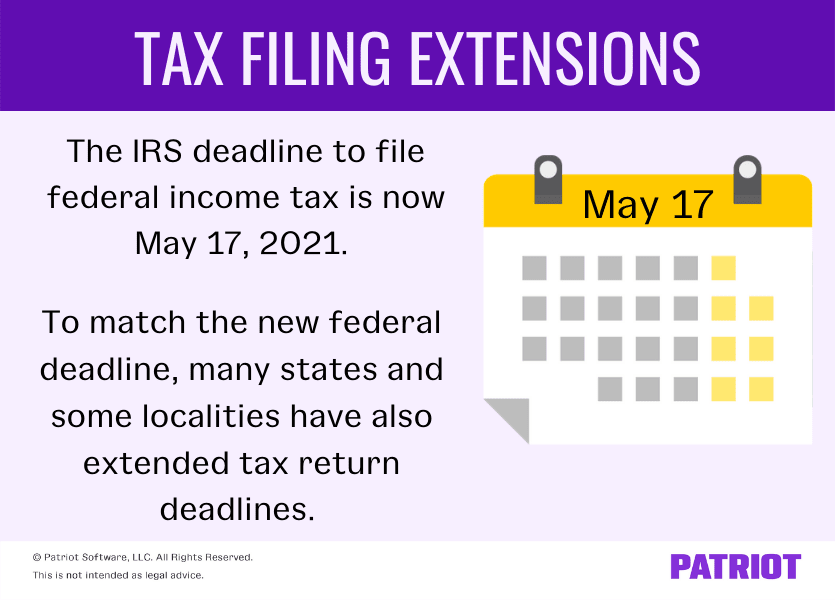

Calendar-year S corporations must file a 2020 income tax return Form 1120S and pay any tax interest and penalties due if an automatic six-month extension was filed. In 2020 the tax deadline was extended to July 15 due to the pandemic and in 2021 it was extended to May 17 as May 15 fell on a Saturday. If your income was above that you can use the IRS free fillable forms.

If youre a sole proprietor filing Schedule C on your personal tax returns the May 17 2021 deadline applies to you too. Form 1099-NEC Nonemployee Compensation is used beginning with tax year 2020 to report nonemployee compensation. Deadline for employees who earned more than 20 in tip income in January 2021 to report this income to their employers.

The payments must be sent to the Internal Revenue Service Center PO. The federal tax filing deadline for individuals has been extended to May 17 2021. Box 409101 Ogden UT 84409.

This is the tax deadline for S Corporations to file their annual tax return. So if you owe taxes for 2020 you have until May 17 2021 to pay them without interest or penalties. Americans who reside in the US normally have to file by April 15.

For calendar year corporations this due date is March 15 2021. If the deadline falls on a Saturday Sunday or any legal holiday the. Partnerships and S corporations can request a six-month extension to file but this does not extend the time to pay any tax due.

These costly penalties are charged to companies who dont file dont pay or dont deposit money due to the IRS in a timely manner. The S corporation has a responsibility to file an informational income tax return each year as well as a range of other IRS forms. Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021.

Due to the COVID-19 pandemic the federal government extended this years federal income tax filing deadline from April 15 2021 to May 17 2021. This tax filing deadline is only subject to change if March 15 falls on. Quarterly estimated tax payments are still due on.

For returns on which no tax is due the penalty is 210 for each month or part of a month up to 12 months the return is late or doesnt include the required information multiplied by the total number of persons who were shareholders in the corporation during any part of the corporations tax year for which the return is due. Deadline for catching up on unpaid fourth-quarter estimated taxes without additional penalties by filing 2020 tax returns. The March 15 deadline will be the same tax filing deadline for S Corps in 2021.

The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax. May 17 is also the deadline to file for an extension to file your individual tax return. This extension is automatic and applies to filing and payments.

Deadline for businesses to mail Forms 1099 and 1096 to the IRS. To ensure proper crediting enter the foreign corporations EIN Form 1120-F or 1120-FSC if applicable estimated tax payment and the tax period to which the payment applies on the check or money order. While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15.

Deadline for filing and paying corporate income. You must apply for a tax extension no later than your typical tax deadline. The due date for providing the 2020 Form 1095-B and 2020 Form 1095-C has been extended from February 1 2021 to March 2 2021.

Calendar-year corporations need to pay the third installment of 2021 estimated income taxes. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021. Calendar-year S corporations must file a 2020 income tax return Form 1120S and pay any tax interest and penalties due if an automatic six-month extension was filed.

Calendar-year corporations need to pay the third installment of 2021 estimated income taxes. Generally an S corporation with a fiscal year must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021.

Will 2021 Tax Deadline Be Extended Again Cpa Practice Advisor

Does California Have A Late Tax Filing Deadline In 2021

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tax Deadlines And Benefits Compliance Deadlines In January 2021 Gusto

5 Step Cpa Tax Preparation Process By Cogneesol Tax Preparation Tax Preparation Services Tax Consulting

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

Irs And Many States Announce Tax Filing Extension For 2020 Returns

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Income Tax Due Dates Income Tax Income Tax Due Date Income

Us Tax Deadlines Updated For Expats Businesses Online Taxman

Post a Comment for "S Corp Tax Deadline 2021 Penalty"