Business Use Of Home Carryover Loss

Using IRS Form 8829. No home depreciation deduction or later recapture of depreciation for the years the simplified option is used.

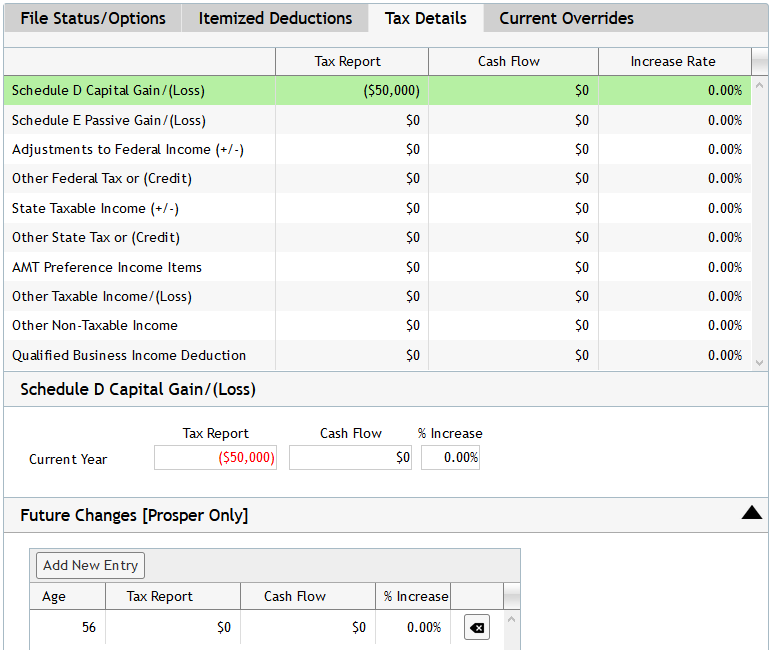

Illustrate A Capital Loss Carryforward In Moneytree Plan S Prosper Reports Moneytree Software

Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction.

Business use of home carryover loss. Allowable home-related itemized deductions claimed in full on Schedule A. She says she really didnt use her home office in 2015. Unlike passive losses that were suspended the expenses for use of the home are not allowed in full on the disposition or discontinuation of.

However you use IRS Schedule K-1 to report your losses. Excess expenses for business use of the home are carried forward on Form 8829 to enable those expenses to be deducted if there is income in a later year. I have a client who is winding down her Sch C business and has a home office deduction carryover.

They dont directly benefit you. However the carryover is not lost for good. For example if only 10 of the square footage of your house is reserved exclusively for business use you can only use 10 of your home expenses as a business deduction.

The carryover is attached to the business and not the house. This limitation is imposed by the IRS not TurboTax. You can deduct home office expenses up to your net income revenues minus other expenses and carry over the rest to the following year.

Mortgage interest real estate taxes. Dont fill out the top section. Under the simplified option for line 30 of Schedule C you enter a the total square footage of your home on the first line and b the square footage of the part of your home used for business on the second line.

As long as your client stays in business he can use that expense carryover. The home office expense carryover is from a prior year s and it occurs when the business associated with the home office has incurred a loss already OR the. Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR.

All he has to do is attach the Form 8829 Office in Home Expenses to his Schedule C. Business losses pass through the business to the owners individual tax returns. If you file Schedule F Form 1040 enter this amount on line 32 Other expenses of Schedule F Form 1040 and enter Business Use of Home on the line beside the entry.

Calculating an NOL gets complicated. I want to simply apply the 8829 carryover as her home office deduction to that income without incurring any more home office deductions. Also if you are using the Simplified Method for your home office expenses on your 2017 return then you cannot use the amounts carried over from a previous year.

If youre the shareholder in a C corporation the corporation deducts any losses not the shareholders. Use the Simplified Method Worksheet in the Schedule C instructions to figure the amount to enter on line 30. Ideally since he has now signed a lease and made more of a commitment to work at this business he is now turning a profit or starting to.

Line 34 is the total other than casualty losses allowable as a deduction for business use of your home. Information about Form 8829 Expenses for Business Use of Your Home including recent updates related forms and instructions on how to file. Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of amounts not deductible this year.

If your operating expenses for the business use of your home are limited you can carry over the nondeductible portion to the following year. She had a little income of 8k. Complete Form 8829 Expenses for Business Use of Your Home.

However your deduction is limited to the percentage of your home that is dedicated exclusively to your business. If If applicable a lender may include analysis of the sale and related recurring capital gains. IRS Form 4797 Sales of Business Property is not included on this worksheet due to its infrequent use.

Standard deduction of 5 per square foot of home used for business maximum 300 square feet. The carryover amount will be subject to the deduction limit for the next year whether or not you are still.

Audits Can Be Intimidating Especially For First Timers But As Your Business Grows To Have It Audited Can Be Bookkeeping And Accounting Bookkeeping Accounting

Capital Gains Losses Including Sale Of Home Pub

Sample Church Financial Report Financial Church Accounting Software Financial Analysis

Schedule D Capital Loss Carryover Scheduled

Google Image Result For Https Bookstore Gpo Gov Sites Default Files Styles Product Page Image Public Covers F104 Capital Gain Capital Gains Tax Irs Tax Forms

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Tax And Income From One Self Occupied Property Income Self Retirement Income

For Any Othe Scenarios You May Message Me At Pontrasto Outlook Com Or Call 713 387 9521 Mortage The Borrowers Home Buying

How To Deal With And Succeed In A Toxic Work Environment Work Environment Quotes Environment Quotes Work Environment

Treasurer Report Template Non Profit New 11 12 Treasurer Report Example Jadegardenwi Com Report Template Word Template Templates

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Free Handout For Slps And Parents Answering What Questions Speech Therapy Materials What If Questions Preschool Speech Therapy

Solved Where Do I Enter Last Year S Qbi Loss Carryover L

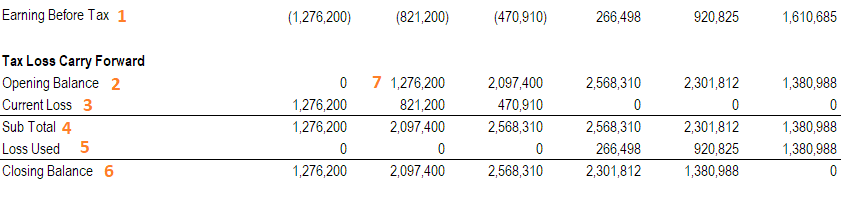

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Irs Capital Loss Carryover Worksheet Fill Out Tax Template Online Us Legal Forms

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Where Do I Enter Prior Year Passive Losses On Rental Property

Turbotax 2019 Not Transferring Capital Loss Carryo

Post a Comment for "Business Use Of Home Carryover Loss"